This content was translated from its original source using an AI model with minor manual editing. The translations may not be perfect and XCH.today does not make any guarantees as to the accuracy or reliability of the translations.

Original source: https://mp.weixin.qq.com/s/3SkPEsRDre9OJzUs-Bikiw

This content was contributed and posted on XCH.today with permission from its creator(s). All opinions and views expressed in the content belong to the content creator and are not necessarily shared by XCH.today. Opinions should not be interpreted as financial advice.

A Short History of Chia and XCH

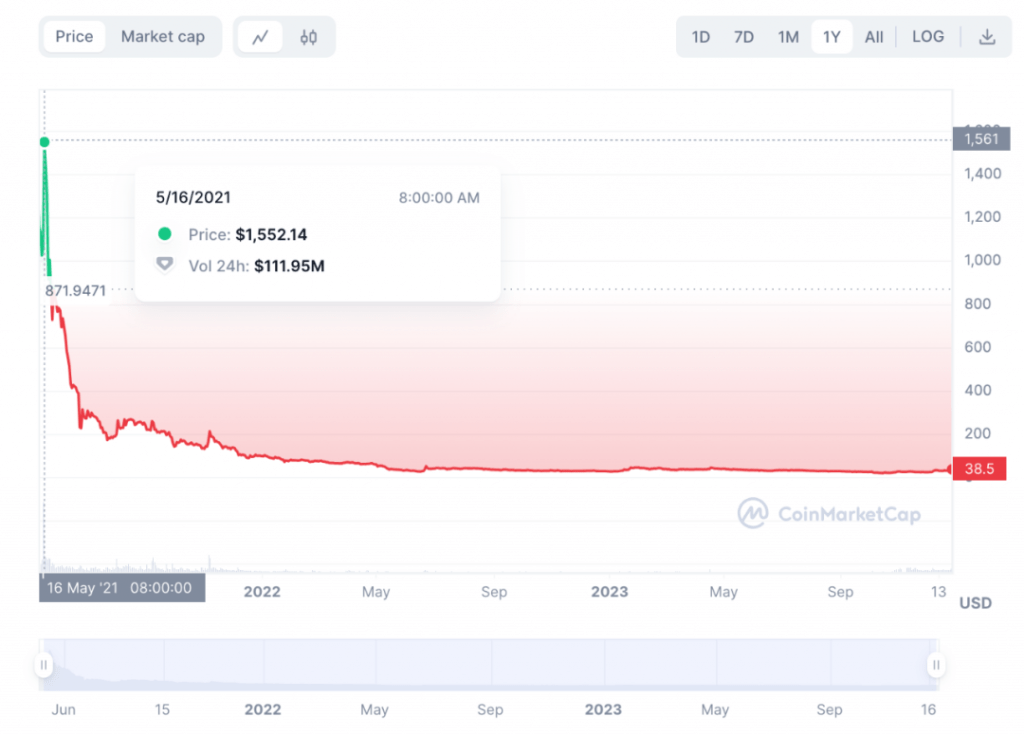

Since XCH was listed on exchanges in May 2021, it has experienced a continuous decline in value, except for a two-month period of high volatility that same year. The price dropped from $1552 to a low of $25, disappointing many fans who were optimistic about Chia at the time. Furthermore, XCH price seems to have little correlation with the overall market, leading many to consider it an outlier or more positively, a maverick in the cryptocurrency industry.

However, Chia is not as perceived. Over the course of more than two years, Chia Network Inc. (CNI) has successively launched infrastructure that is considered advanced in the industry. The development progress aligns closely with the disclosed roadmap. Moreover, in addressing real-world applications for governments, enterprises, and institutions, Chia has taken solid strides, being the first in the industry to truly apply public blockchain on a global scale.

Many people’s understanding of Chia still remains rooted in traditional perspectives of the cryptocurrency market. The absence of DeFi, stablecoin support, and market makers leads to the belief that there is no speculative space and consequently, a lack of enthusiasm. Even now, there are quite a few individuals who view Chia as a blockchain for storage. They often compare Chia to Filecoin, unaware that Chia is a Layer 1 public blockchain.

“Even now, there are quite a few individuals who view Chia as a blockchain for storage. They often compare Chia to Filecoin, unaware that Chia is a Layer 1 public blockchain.”

Undeniably, from the perspective of financial capital, Chia’s value growth has been slow and completely contrary to the speculative market’s motto of making quick fortunes in the cryptocurrency world. Over the course of more than two years, despite receiving investments, including $61 million from a16z, its total market value has remained around $300 million. Furthermore, in October of this year, due to the impact of the bankruptcy and acquisition of their bank, Credit Suisse, by UBS, there was a temporary financial strain, leading to a one-third reduction in staff.

However, those who truly understand the history of blockchain development and uphold the spirit of Satoshi Nakamoto are aware that the rise of blockchain technology is driven by the ideal of overthrowing the autocracy of centralized financial institutions. Through cryptographic algorithm technology, it aims to achieve fair, transparent, permissionless, and trustless peer-to-peer transactions, reducing intermediaries and preventing wrongdoing by centralized institutions.

Financial leverage undoubtedly plays a crucial role in the development of blockchain and cryptocurrency. The wealth creation effect has always been the most effective tool for concentrating individual and institutional capital, promoting rapid industry development. However, any advanced technology cannot always thrive in financial bubbles; it must return to practical applications, establish production partnerships, and enhance the end product.

Market Maker or Fundamentals?

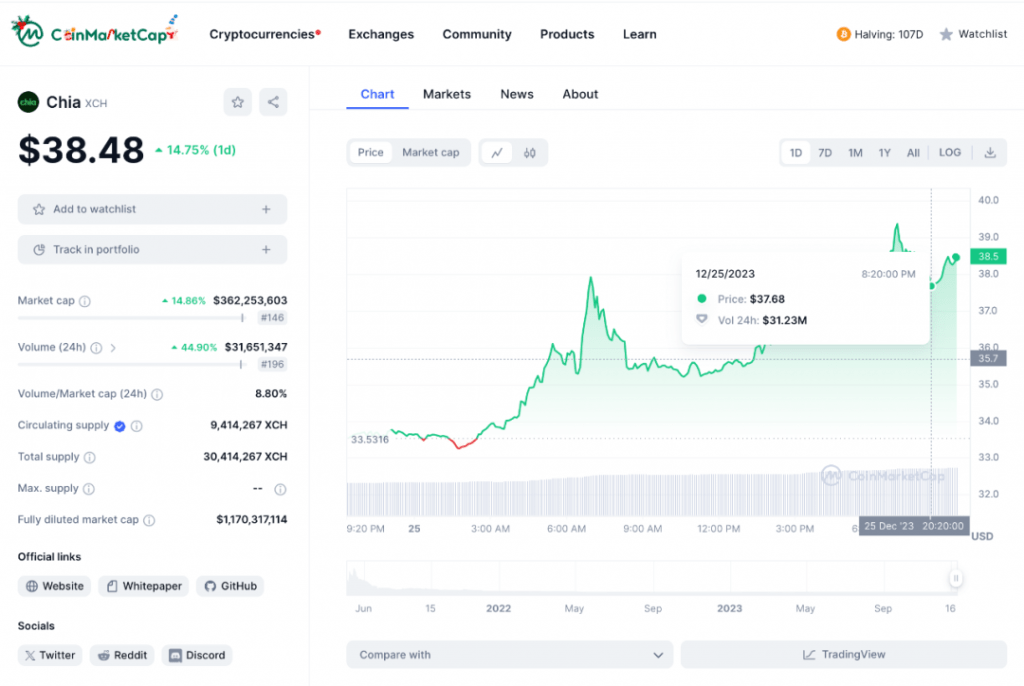

After Chia announced finding a new market maker and lent a total of 250,000 pre-mined tokens (XCH) in two consecutive transactions on October 14, 2023 and December 8, 2023 the price of XCH began to fluctuate. Today (December 25, 2023) it had a 14.75% price increase, a 44.9% increase in trading volume, and a 14.86% increase in total market value.

Many people believe that this is the market maker’s manipulation, but we should analyze the underlying value logic. Although Chia is still under development and has a long way to go, its solid and continuous technical development over the past two years, along with its influence in the B2B business sector, is gradually revealing its inherent attractiveness.

As a Layer 1 public blockchain, Chia currently has foundational advantages:

- The most decentralized blockchain infrastructure globally, with nearly 100,000 full nodes distributed across continents, achieving a high Nakamoto Coefficient.

- Utilizing a large number of existing computer hard drives (primarily second-hand drives) as hardware for its Proof of Space and Time (PoST) consensus, which is easily accessible, energy-efficient, and challenging for ASIC customization to gain an advantage. The innovative mining pool protocol effectively prevents centralization trends.

- An improved UTXO model, using coins as first class objects, sacrificing some convenience for maximum security (Editor’s note: I do not believe coin set sacrifices convenience compared to UTXO. Read more about the differences here). Leveraging the unique Chialisp language, coins become extensible and programmable smart coins.

- Chia’s Offer Files, in simple and concise text form, enable trustless peer-to-peer transactions that are secure, reliable, and easy to propagate. Offer Files can trade not only XCH but also CATs and NFTs, even in mixed transactions.

- Chia’s NFT1 standard enforces royalties, protecting creators’ copyright revenue, breaking free from dependence on centralized marketplaces. Multiple URLs prevent data obliteration, and when combined with DID standards, ownership can be recorded and traversed.

- Chia’s VC standard (Verifiable Credential) provides tools for government, enterprise, and organization KYC authentication. It can be certified on-chain or off-chain and, when combined with other functions like token primitives, facilitates the issuance of compliant security tokens while complying with regulatory rules.

- Chia’s Clawback standard, for the first time on a Layer 1 blockchain, allows wallet owners to roll back transactions (undo transactions) after sending them, effectively preventing losses from errors such as mistyped addresses or phishing sites, safeguarding user asset security.

- Chia’s DataLayer standard empowers enterprises and organizations to manage access to submitted data among selected participants, adapting flexibly to diverse organizational needs for data sharing, auditing, and modification.

- The Chia ecosystem has established stable DEX decentralized exchanges, feature-rich blockchain browsers, comprehensive NFT markets, complete minting tools, secure and convenient web and mobile wallets, and early-stage AMM trading markets and stablecoin on-ramps.

For a more comprehensive understanding of Chia’s technical roadmap, refer to the Chia development roadmap.

(Editor’s note: Also see Q3 2023 Chia Product Roadmap Update – What You Need to Know)

Chain Usage: Inscriptions and CAD Trust

However, recently, especially with today’s rise in XCH price, more contributing factors may come from two aspects:

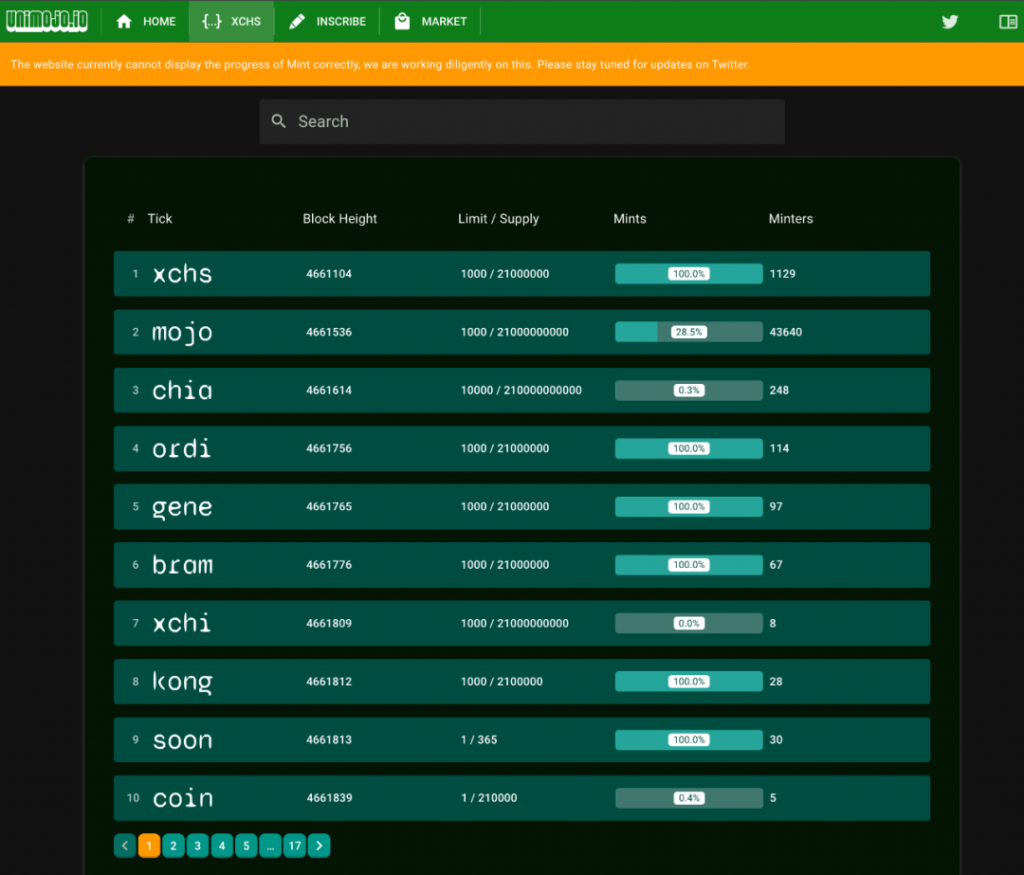

On the retail front, the trend of inscriptions across blockchains has taken hold within the Chia community, creating a fervor for XCHS inscriptions in the Chia community. Since its launch on December 15, 2023, it has maintained high engagement, leading to congestion in Chia’s mempool, and minimum transaction fees have surged from zero to around 0.001 XCH!

Chia’s inscriptions, particularly XCHS inscriptions, differ significantly from inscriptions on other chains. They cleverly utilize Chia’s memo feature, binding it with wallet addresses rather than engraving it directly on the coin. What adds even more room for imagination is that XCHS inscriptions attempt to explore the combination of the UTXO model and the account model, injecting more economically convenient and scalable opportunities into the Chia ecosystem, which has sacrificed some convenience for security.

| Low Fee | Smart Contract | Account Model | |

| BTC | ❌ | ❌ | ❌ |

| BRC-20 | ❌ | ✅ | ❌ |

| ETH | ❌ | ✅ | ✅ |

| ETHS | ✅ | ✅ | ✅ |

| XCH | ✅ | ✅ | ❌ |

| XCHS | ✅ | ✅ | ✅ |

After the launch of XCHS, the entire Chia community, both domestically and internationally, has unanimously embraced it. Currently, 165 unique inscriptions have been introduced, with the participation addresses for “mojo” reaching an impressive 43,640. (Editor’s note: this does not necessarily equate to the number of unique individuals participating).

The XCHS Twitter account announced today that it will create a second-layer chain for inscriptions and develop an indexer on it, greatly enhancing security. This move stands in contrast to other chain indexers, which due to being stored on servers, face common centralization risks.

For a more comprehensive description of XCHS inscriptions, you can refer to the HemaDAO public account articles:

On the B2B front, Chia has made significant progress with implementing the CAD Trust platform for carbon tracking. Since its establishment at the end of 2022 with the support of the Singaporean government, CAD Trust has actively developed dashboards based on the Chia blockchain and has onboarded carbon registration agencies, verification agencies, and carbon projects worldwide. As of now, over 17,000 projects have been onboarded, with over 6,000 from China. Bhutan’s government, as the first national-level institution, has also registered on CADT.

After the COP28 conference in November 2023, major institutions guiding the promotion of CADT, including the World Bank, Verra, Gold Standard, IFC, IETA, and EcoRegistry, which have significant influence in the voluntary carbon trading market, are participating. It can be said that 80% of issued carbon market is being tracked on CADT.

Chia has also been in talks with banks and the luxury goods industry, with actual cooperative projects expected to surface within 6-9 months.

Chia has developed a carbon tokenization engine for CADT, and carbon emission projects can use the CAT2 standard on Chia to tokenize carbon credits as per their progress. These tokens can then be traded on decentralized exchanges within the Chia ecosystem, such as dexie. This will greatly boost Chia’s influence in traditional businesses.

Chia has also been in talks with banks and the luxury goods industry, with actual cooperative projects expected to surface within 6-9 months.

Conclusion

For more information about Chia’s applications in carbon trading, refer to the HemaDAO public account articles:

- Climate Warehouse Application, Chia DataLayer Demo

- Chia Climate Warehouse III Phase Final Acceptance!

- CAD Trust Explodes on the Chia Blockchain

Considering the above analysis, XCH’s recent price increase is not merely the result of market maker activities but rather the gradual release of its accumulated value. Chia enthusiasts can delve deeper and pay attention to the underlying logic of Chia to truly understand the trends in Chia’s future development and stay well-informed.

[…] XCH.today welcoming its first contributed article courtesy of @chia_inchina! “Opinion: Why is XCH price going up?“. […]