This week, Chia Network Inc. moved part of its strategic reserve (prefarm) to be *loaned* to a market maker (MM). Here’s what we know so far and what it could mean for Chia and XCH.

What exactly happened?

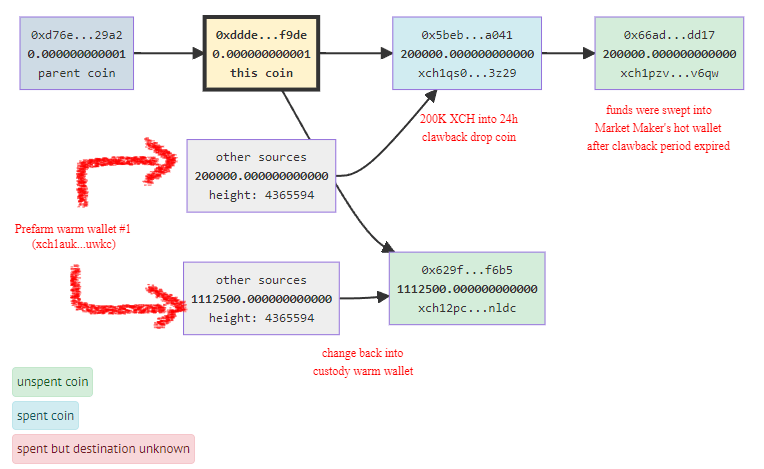

- One of the two prefarm warm wallets was spent, with 200K XCH going into a 24h clawback drop coin

- 1.1M XCH went back to a custody address as change

- 20min after the clawback period expired, the MM swept the XCH into their hot wallet

Who is the market maker?

- We haven’t heard officially yet but we know they are a traditional market maker (think GSR)

- They are *not* an AMM like TibetSwap

- They’re not the biggest in the industry but are certainly reputable – They may work across CEXs *and* DEXs

What are the terms of the loan?

- The loan period is 90 days but CNI has option to roll forward

- The loan is repaid in XCH but the interest (if any) is paid in fiat

- Part of 200K XCH is sent to the MM hot wallet, not as a loan.

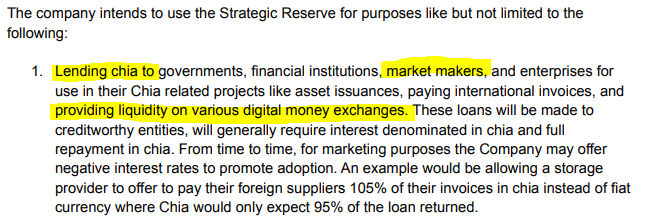

Note that XCH loans to market makers was clearly spelled out as a potential use of the Strategic Reserve in the whitepaper.

What does a market maker do?

Market makers provide liquidity and depth across multiple exchanges and profit from bid-ask spreads. For example, if want to buy 10K XCH on Crypto.com today? Not possible. A market maker can help fulfill such an order by bridging liquidity across higher depth exchanges.

What do I expect?

I expect to see lower volatility on XCH price across the market as well as more consistent XCH prices across exchanges with lower slippage on large orders. I also expect a healthier market where prices are less easily manipulated.

What else could this mean?

Baseless speculation here, but it could mean

- A step to more exchanges listing XCH as they need liquidity to see volume

- CNI can use the MM to help sell XCH into market with reduced price impact

- MM can play on DEXs too…

What bridging CEX and DEX could mean?

- ETH bridge is around the corner, bringing wrapped ETH and wrapped USDC as native asset tokens on Chia

- A market maker can provide liquidity on these CATs on dexie or TibetSwap

to make the ETH bridge the easiest on-ramp into XCH

Imagine buying USDC on Coinbase, bridging it to Chia as wUSDC, and trading it for XCH via Offer Files. Short of a direct Coinbase listing, this can be the safest and most accessible for many US residents to acquire XCH. But we’d need liquidity on the wUSDC/XCH pair — something a market maker could help provide.

The Chia Network team will be hosting an AMA in the coming weeks to fill in more details about this. Until then, I’m expecting the market maker to spring into action tomorrow and I’m excited to see how things play out!

2023/10/16 Update

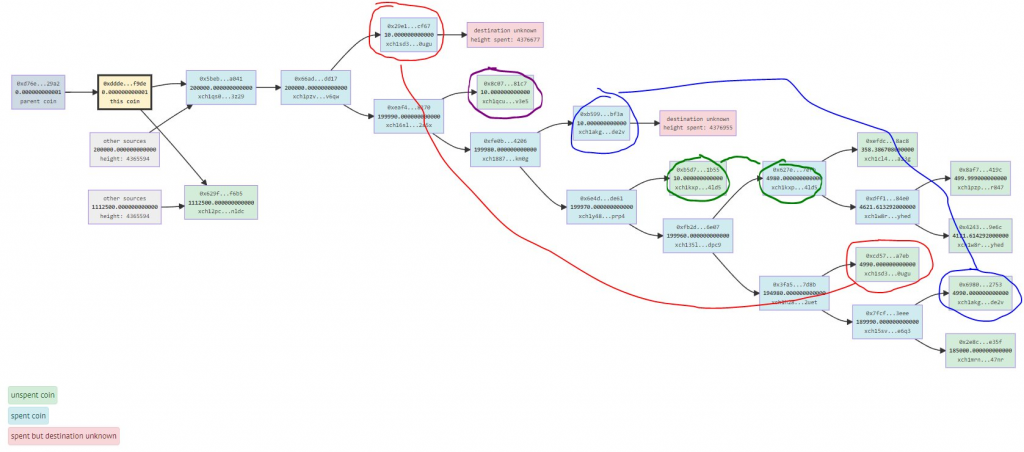

Looks like four test transactions of 10 XCH to different addresses, followed by a ~4990 XCH transaction to three of them. My best guess is they’re depositing ~5000 XCH across four exchanges.

2023/10/24 Update

Another update on Chia’s market maker’s activity. More XCH transactions were sent. In total that makes 5 potential exchange deposit addresses, with the following totals:

- 0ugu: 15000 XCH

- v3e5+4qd5: 15000 XCH

- de2v: 15000 XCH

- 9vdz: 2500 XCH

My guess remains that they’re currently active on 4 CEXs.

2023/11/26 Update

The market maker has mobilized another 70,000 XCH. In total, they’ve moved 117,500 XCH of their 200,000 XCH.

[…] What does a Market Maker do? See the first post. […]

[…] Chia announced finding a new market maker and lent a total of 250,000 pre-mined tokens (XCH) in two consecutive transactions on October 14, […]

[…] Network’s Strategic Reserve has already been tapped twice to engage a market maker. I’m not a frequent trader so I have not noticed a change in liquidity across exchanges but […]

[…] 1st round (200,000 XCH): Chia Network Provides Loan to Market Maker […]

[…] liquidity, the other 2/3rds is marked for sale on behalf of CNI.Editor’s note: Read about the first, second, third round of transfers to the market […]

[…] Oct 13, 2023 (200,000 XCH): Chia Network Provides Loan to Market Maker […]

[…] Oct 13, 2023 (200,000 XCH): Chia Network Provides Loan to Market Maker […]