The Chia product roadmap had a number of exciting items in its last update in Q3 2023, many of which were delivered since then. Here are the top 10 things I’m predicting will happen in 2024 for the Chia blockchain and ecosystem.

Personal opinion follows, not financial advice. Let me know your thoughts in the comments.

#10 We’ll hear an update on IPO, but no actual IPO in 2024

As expected, it has been radio silence from the CNI team since the confidential draft registration filing to the SEC in April 2023. My guess is the market may not be ready for a blockchain software company to IPO in 2024 but I predict we’ll hear more about the progress and may even see the contents of filing itself along with a more concrete date some time this year.

#9 More of the prefarm will be leveraged

Chia Network’s Strategic Reserve has already been tapped twice to engage a market maker. I’m not a frequent trader so I have not noticed a change in liquidity across exchanges but the effective increase in circulating supply does not seem to have adversely affected the markets. I expect the company to have gained comfort and clarity in the use of the prefarm and I predict they will leverage more of it in 2024 to fund operations as well as jump-start ecosystem development. For example by relaunching a form of the cultivation grant program.

#8 XCH won’t get a Coinbase or Binance exchange listing

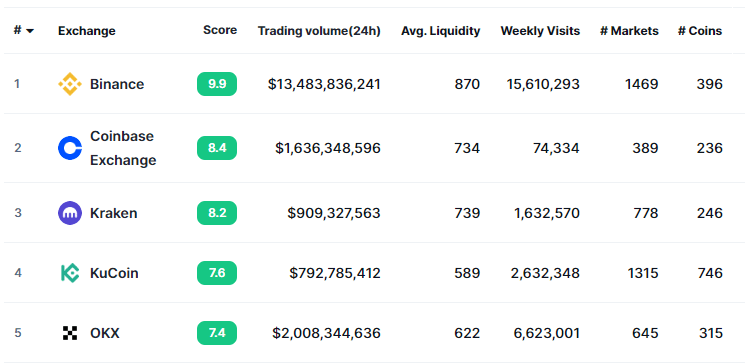

When it comes to the centralized exchanges, the two that are most noteworthy are Binance and Coinbase. I don’t predict we’ll see either list XCH in 2024 despite the blockchain’s reputation as a serious player. This is because the volumes have not historically been high enough to justify the technical effort in implementing a new Layer 1 as exchanges make much of their revenue on trading fees.

Note that XCH is already available on the next three biggest exchanges: Kraken (OTC), KuCoin, and OKX. 2024-01-19 correction: XCH is not yet available on Kraken, the OTC page is under review.

#7 It will be easier to acquire XCH with the ETH-XCH bridge

In spite of the previous prediction of not being listed on Binance or Coinbase, I predict XCH will be easier to acquire (especially for US citizens) in 2024 with the launch of the ETH-XCH bridge. Specifically, I predict the bridge will go into testnet before the middle of the year and be in mainnet by the end of the year.

The ETH-XCH bridge will allow users to:

- Send ETH to the bridge (on Ethereum), and receive wrapped-ETH (on Chia).

- Send USDC to the bridge (on Ethereum), and receive wrapped-USDC (on Chia).

- Send wrapped-ETH to the bridge (on Chia), and receive ETH (on Ethereum).

- Send wrapped-USDC to the bridge (on Chia), and receive USDC (on Ethereum).

This means a fairly safe way to acquire XCH will be to:

- Buy USDC on Coinbase.

- Send USDC to the bridge and receive wUSDC in your Chia wallet.

- Swap wUSDC for XCH on Tibetswap or dexie.

The above assumes there is sufficient liquidity in the Chia ecosystem to support wETH and wUSDC pairs — and I predict there will be, as it is a fairly straightforward arbitrage opportunity for market players to set up once the bridge is functional.

#6 Chia will go from zero to 3 stablecoins

Speaking of USDC, I predict Chia will see several “new” stablecoins in 2024.

- wUSDC: Wrapped USDC through ETH-XCH bridge

- USDS: Stably re-launch

- BYC: CircuitDAO Bytecash

The previous stablecoin issuer, Stably, is set to relaunch a USDS stablecoin after having to shut down last year due to insolvency of their custodian, Prime Trust. The old token will be renamed USDS Classic (USDSC).

Circuit DAO is also slated to launch in 2024 with their Bytecash (BYC) stablecoin, backed by overcollateralized XCH. This will be an interesting project to watch.

To me, the exciting thing about having multiple stablecoins are the opportunities to provide liquidity on AMMs like TibetSwap at lower risk of impermanent loss assuming neither side de-pegs. Having high liquidity to move between stablecoins is critical as to not dilute the effective liquidity on non-stablecoin pairs.

#5 NFTs make a comeback

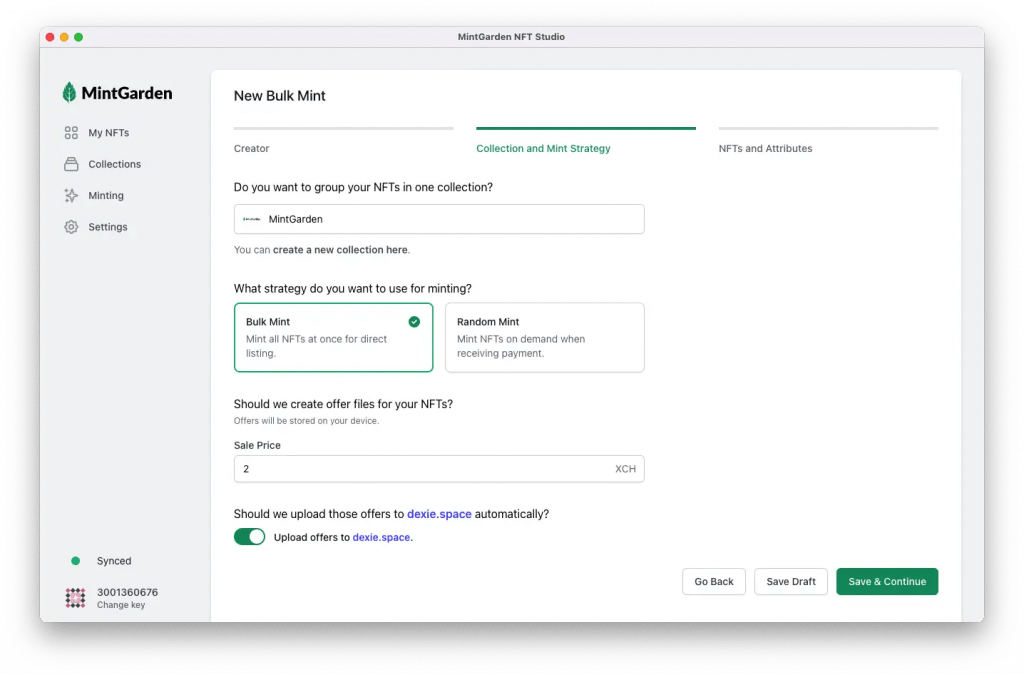

I predict we will see a resurgence of interest in NFTs. With a fee market having taken hold, there is now a financial threshold to minting NFT collections, especially large 10K generative ones. This could mean fewer but higher quality collections. I also predict Chia Friends to remain the blue chip NFT project on Chia along with a few other projects with proven staying power like MonkeyZoo and God of Crypto.

Coupled with new features from the ecosystem such as MintGarden Premium, the experience for collectors and creators is only going to improve in 2024.

#4 Fee pressure reduces but does not fully go away

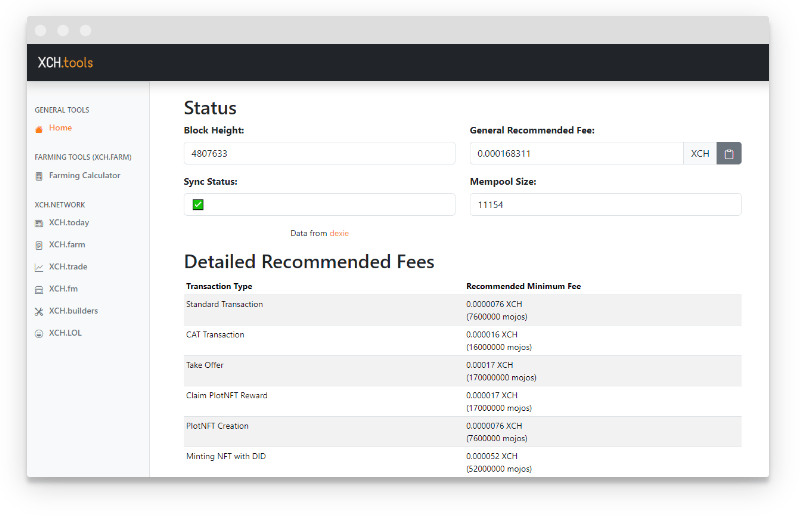

An established fee market is a great milestone for a blockchain and bodes well for its long term security. With inscriptions coming to Chia, a fee market was ushered in overnight and users needed to adapt by building a new understanding of how fees work while developers innovated on new solutions to smooth the user experience. (Self plug: I put up a quick fee estimator for different transaction types on XCH.tools).

Even Chia Network published a blog post explaining the mempool and how fees work on Chia.

We’ve already seen the mempool start draining but I predict the days of truly zero fee are over. I also don’t predict fee pressure going up significantly, fractions of a penny per transaction is probably where we’ll sit in 2024.

#3 Two more big partnerships outside of carbon credits will be announced by Chia Network

Working with enterprises and governments can be a slow and arduous process where progress is measured in quarters, not weeks. Chia Network has mentioned a number of potential partners in the past that are in “late stage pipeline” which is promising but it is also normal for some partnerships to not come to fruition for one reason or another. This can be especially true during trying financial times when priorities can often shift.

That said, I’m predicting in 2024, we will hear about at least two notable partnerships. I won’t speculate as to exactly which they are but I’m expecting them to be outside of the carbon markets.

#2 iOS Signer gets released but retail will struggle to understand its importance

The iOS signer app is one of the roadmap items I’m most highly anticipating. I believe it will unlock a new standard for a more user friendly and secure way to handle crypto self-custody. But I also think there’s a large knowledge gap in what retail needs versus what retail understands — much like Offer Files where the advantages and potential often falls on deaf ears.

However, such an app could prove valuable as part of a more comprehensive custody solution for enterprises and banks, where a simple multi-sig setup is a non-starter for any serious use case of blockchain.

Honorable Mention: Michael Taylor builds a bunch of stuff

@michaeltaylor3d is building groundbreaking and innovative things with Chia DataLayer and I’d be remiss to not at least mention them but with the pace at which he has been developing, it’s more of a guarantee than a prediction.

Look forward to more written content on XCH.today about this topic.

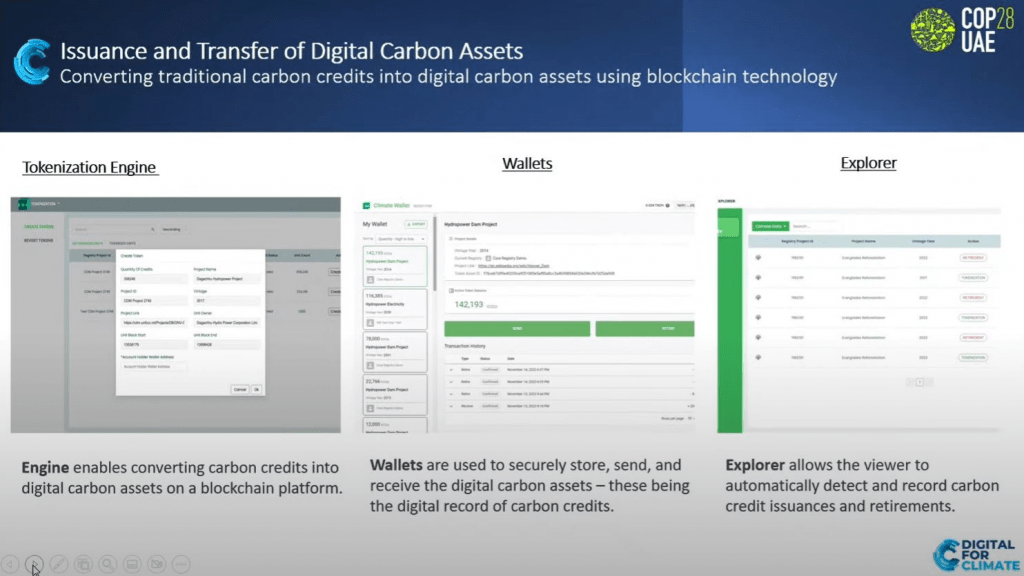

#1 Tokenized carbon credits pick up steam

The growth of CADTrust was the most notable event of 2023 in my opinion. Part of the end-to-end solution created between the World Bank and Chia Network is the technology stack that allows tokenization and retirement of carbon credits as CATs on the Chia blockchain. We already saw isolated examples of this happening on-chain in 2023. I’m predicting we will see carbon be tokenized, traded, and retired on Chia more systematically in 2024. Whether or not they show up on public marketplaces is a separate question.

Summary: Top 10 Chia Predictions for 2024

What do you think of my predictions? Did I miss something? Let me know in the comments!

More from around the community

Home Datacenter YouTuber Digital Spaceport gives his predictions for Chia and future outlook for XCH.

Renowned Twitter troll @xchbob (not to be confused with Keybase bob) gives his predictions in the form of memes in this Twitter thread.

Notable YouTuber and crypto miner VoskCoin gives his outlook for XCH in 2024 from a farmer’s perspective.

[…] “Top 10 Chia Predictions for 2024” article over on XCH.today! […]

[…] It was noted in Discord that the majority of this transfer from the prefarm will be sold over time, in the same way as portions of the previous transfers. (Called it!) […]

[…] Read more: Top 10 Chia Predictions for 2024 […]

[…] ETH-XCH bridge was one of my top 10 predictions for 2024 as a means to more easily on-ramp into XCH. Gene also mentioned improving on and off-ramps as one […]