The information provided in this article is for informational purposes only and should not be considered as investment or financial advice.

Since the initial announcement in October 2023 of Chia Network mobilizing the warm wallets of the prefarm to loan, sell, and otherwise pay for services in XCH, there has been a narrative that this action has negatively impacted XCH price. Is this true? Let’s dive into an analysis to see how Chia Network’s prefarm sales has affected XCH price.

To recap the prefarm movements:

- Oct 13, 2023 (100,000 XCH Loan, 100,000 XCH Sold): Chia Network Provides Loan to Market Maker

- Dec 7, 2023 (50,000 XCH sold): Update: Chia Network Makes Second Transfer to Market Maker

- Feb 1, 2024 (50,000 XCH sold): Chia Network Sends Third Round of XCH from Strategic Reserve to Market Maker

- Mar 20, 2024 (50,000 XCH sold)

- April 3, 2024 (50,000 XCH sold, 47,872 XCH marketing partner)

- May 7, 2024 (50,000 XCH sold): Chia Network Sends Sixth Round of XCH from Strategic Reserve to Market Maker

- June 27, 2024 (50,000 XCH marked for sale)

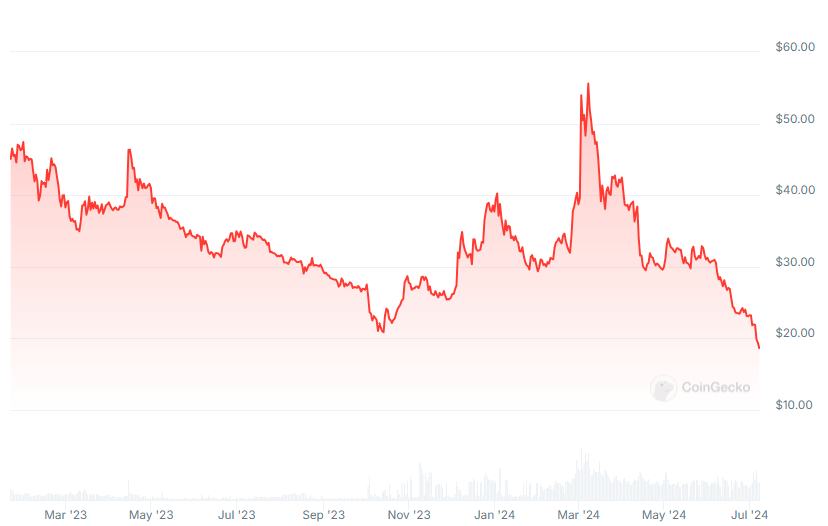

XCH Price is at an All-Time Low

The price of XCH has been steadily declining since the block reward halving in March 2024, after having peaked at a high of over $55. Combined with the plot filter reduction in June 2024, farming profitability is at an all time low. This is partially countered by a decline in netspace but not enough to maintain farmer rewards. Netspace will likely continue to decline as we enter summer months in the northern hemisphere if XCH price continues on this trajectory.

But how much of this price decline can be attributed to Chia Network steadily selling the prefarm at a rate of ~50,000 XCH per month? Basic supply and demand would dictate there will be a negative impact but let’s dive into an analysis to confirm.

Isolating the Impact

There are a few factors we should account for in the analysis in an attempt to isolate the impact of prefarm sales on XCH price:

- Broader macroeconomic and crypto market trends

- Continued supply inflation (including prefarm transfers entering circulating supply)

Macroeconomic and Crypto Market Trends

Simply looking at the XCH/USD price chart will not account for macroeconomic trends as well as crypto market trends (namely Bitcoin) that impact all other coins. In order to look at the relative performance of XCH, I will instead consider the XCH/ETH pair given Ethereum is viewed as a close competitor to Chia. I had also looked at XCH/BTC with similar results.

A weakening US dollar (through high inflation) would have a positive effect on assets priced against USD so by looking at XCH/ETH this effect is removed as well.

Continued Supply Inflation

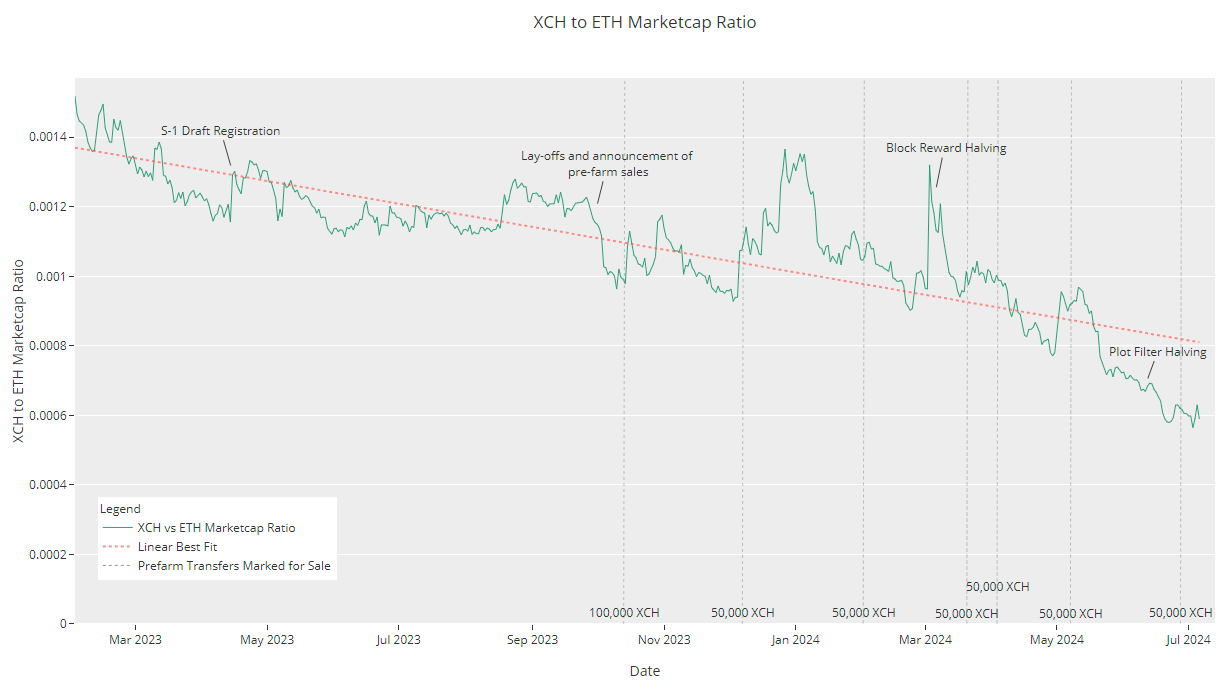

XCH has inflationary tokenomics by design. The all-time price chart reflects this as seen in the rapid decrease in price during the highest inflationary period of the coin. Though the inflation rate has dropped significantly after the first reward halving in March 2024, the rate is still relatively high and a decreasing coin price is expected with all things being equal. I will instead consider marketcap instead of coin price of the XCH/ETH pair.

Prefarm sales have also increased the circulating supply and in theory should increase inflation as well but neither Coinmarketcap nor Coingecko has taken this into consideration when determining circulating supply and marketcap.

I computed an adjusted circulating supply manually via on-chain data of block coinbase rewards and adding in prefarm XCH at a constant rate that reflects all transfers (loans, marketing, and sales). This adjusted circulating supply was used to calculate an adjusted daily marketcap based on historic price data from Coingecko.

The Analysis

The ratio of XCH (adjusted) marketcap to ETH marketcap for the last 1.5 years is charted above (click to zoom in). Significant events are annotated as well.

From staring at this chart, I posit the following conclusions:

Conclusion 1: XCH price has been consistently underperforming well before prefarm sales

The dotted red line represents the (linear) line of best fit during the past 1.5 years where there is an obvious downward trend. Remember this already accounts for inflation so a negative slope is an indication of underperformance relative to Ethereum.

This trend is evident when compared to Bitcoin and other large cap L1 native assets as well.

Conclusion 2: It is not obvious that prefarm sales have accelerated the underperformance

As we have seen from a past analysis of prefarm transfers and movements, sales are likely not happening all at once but rather spread out over several weeks. In the weeks following each of the first five prefarm transfers, I do not see much deviation from the line of best fit.

In other words, XCH has continued along its downward trend that started well before layoffs and prefarm sales. Neither the sentiment of Chia Network mobilizing the prefarm nor prefarm sales themselves appear to have accelerated this trend.

The most recent month has shown a sharp turn towards the downside, especially after the Plot Filter halving. This might be explained by capitulation of disillusioned farmers, or even recent events such as Mt.Gox creditor payouts that resulted in altcoins being impacted more negatively in the short term.

A revisit of this analysis later will show if this hypothesis holds true.

Speculation: Prefarm sales create demand for XCH … from somewhere

This last takeaway is more speculation than conclusion.

Basic Supply and Demand would dictate that selling 50,000 XCH per month (increasing supply in the market) will decrease price unless it is met by increased demand. So where is this demand coming from?

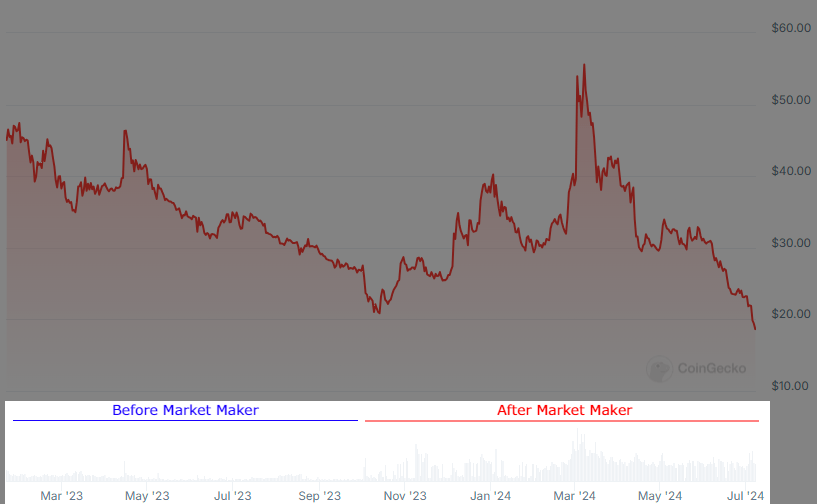

Compared to monthly trading volume, 50,000 XCH is certainly a small percentage but there has also been an increase in trade volume since the market maker was engaged — even after accounting for wash trading from certain exchanges. To me, this increased trading (likely both human and bot) activity is due to a healthier and more liquid market enabled directly by the market maker.

I think there is latent demand coming into the market to meet the increased supply of XCH. This is demand that might otherwise sit on the sidelines. A possibility is an entity that is looking to acquire a large amount of XCH but has been unable to prior due to low liquidity in the markets.

What do you think? Let me know in the comments or find me at @SlowestTimelord on X.

Update (07/09/2024): Clarified wording of conclusions. Clarified loan/sale amounts in prefarm movement recap.

[…] First for an in depth analysis I would recommend you go and read @SlowestTimelord ‘s great article around this topic – and specifically on whether CNI’s pre-farm sales have significantly impacted XCH price. […]

[…] “How has Chia Network’s Prefarm Sales Affected XCH Price?” […]