What is Aerodrome?

Aerodrome is the primary trading hub of the Base chain, an L2 on Ethereum run by Coinbase. It is most notably an AMM (similar to Tibetswap or Uniswap) as well as a collection of protocols for incentivizing liquidity, farming yield, and ultimately enabling low slippage swaps.

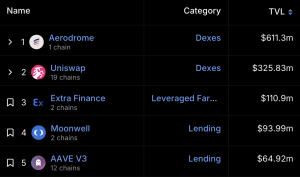

As of June 2024, Aerodrome has the highest TVL (total value locked) on Base with over $600M, almost twice that of Uniswap on Base.

What does a DEX on Base have to do with Chia?

With the introduction of the warp.green bridge last month, assets can be now be bridged (warped) between Ethereum, Base, and Chia. The two most popular assets in each direction are:

- ERC-20 Bridge: USDC on Base → wUSDC on Chia

- CAT Bridge: XCH on Chia → wXCH on Base

These wrapped (warped) assets enable highly accessible gateways to go from USDC to XCH and vice versa.

For example, someone that owns USDC on Base and wants to get XCH into a Chia wallet can go through one of two routes:

- USDC → Aerodrome → wXCH → warp.green → XCH

- USDC → warp.green → wUSDC → Dexie/Tibetswap → XCH

The difference is whether the swap happens on Base or Chia, but either way it leverages the warp.green bridge to convert assets from one chain to the other. The reverse is also true for selling XCH into USDC.

For users, the choice of which route to take is highly dependent on the amount of liquidity available in each ecosystem to give the best prices for either buying or selling XCH. As of the time of writing there is over $550,000 in total value locked (TVL) in the wXCH/USDC pair on Aerodrome compared to the just over $10,000 locked in the XCH/wUSDC.b pair on TibetSwap.

Aerodrome is currently much closer to achieving the goal of low slippage swaps for XCH — let’s find out why.

The Levels of Engagement with Aerodrome

There are different ways to engage with Aerodrome, from simply using it to buy or sell XCH, to providing liquidity with your XCH to earn yield. You can even create incentive for others to contribute liquidity to the pair. We’ll walk through each level of engagement.

Level 1: Buying/Selling XCH using Aerodrome

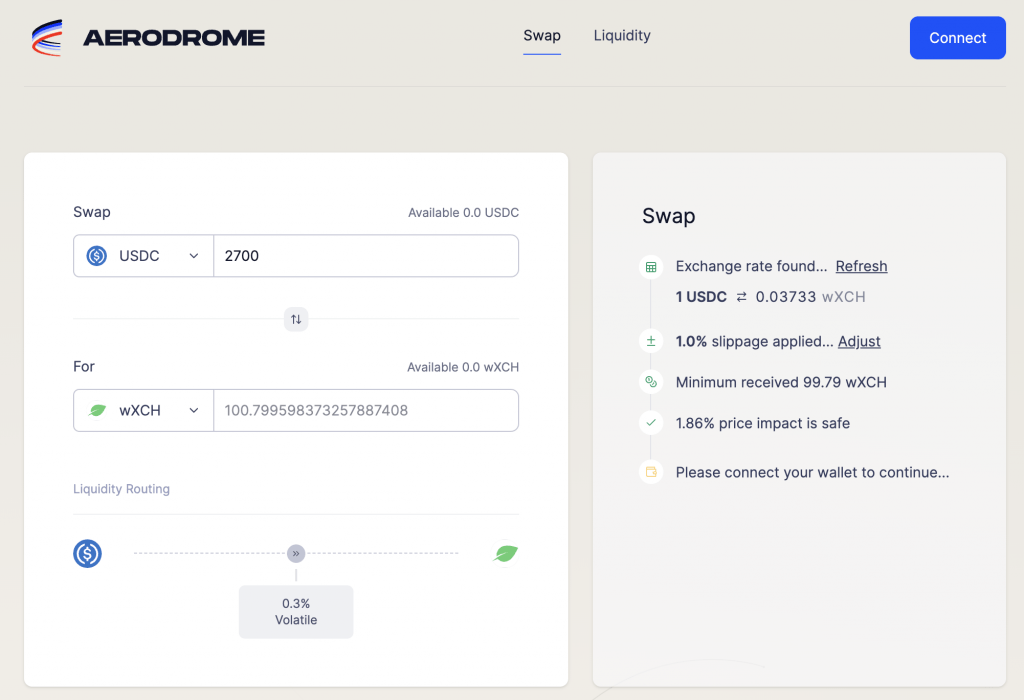

At the most basic level you can use Aerodrome as an AMM to trade on the wXCH/USDC pair and use warp.green to bridge assets back and forth between chains. The swap fee is reasonable (0.3%) but the thing to watch out for is slippage — the amount the price moves as a result of your purchase.

Higher liquidity locked into this wXCH/USDC pool will reduce slippage for users. So where does the liquidity come from? That’s Level 2.

Level 2: Providing liquidity for wXCH pairs to earn yield

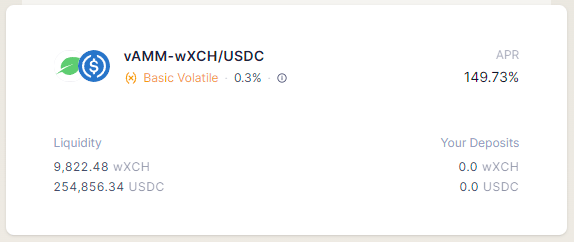

Providing liquidity into a liquidity pool is a common way to earn yield on your assets. You can do this by depositing and staking equal parts of wXCH and USDC into the liquidity pool. Then you just sit back and earn yield from incentives, distributed in the form of AERO tokens which can be swapped into wXCH or USDC, or simply held.

The biggest risk with providing liquidity is impermanent loss, which is when large price movements result in a different balance of the assets in the pool, and when you withdraw liquidity you could discover that you would have been ahead by simply holding the underlying assets.

As of time of writing, the APR for the wXCH/USDC liquidity pool is a whopping 150%. However as more users lock liquidity, rewards are spread amongst more users and the APR will decrease.

So where does the incentive come from and where does the 0.3% transaction fee go? That’s Level 3.

Level 3: Voting to boost wXCH incentives each week

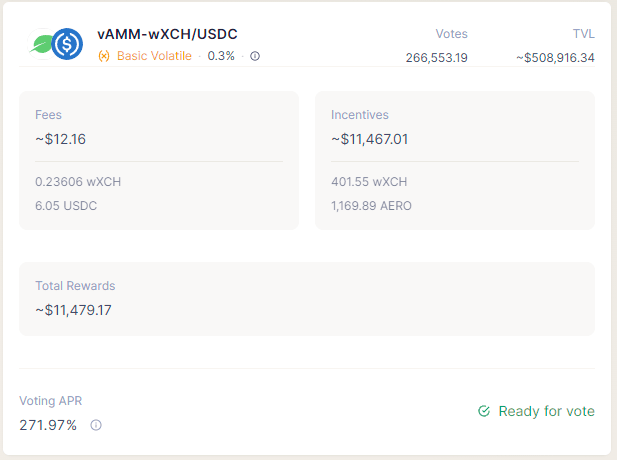

The Aerodrome protocol mints new AERO every epoch (week) to boost incentives for liquidity pools. Users can vote on which liquidity pools should receive these emissions. In return for helping govern the protocol emissions, voters earn a share of the pool’s 0.3% transaction fees as well as any manually added incentives.

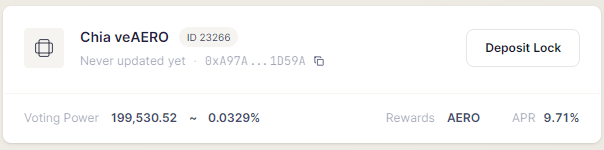

Voting requires you to lock AERO for a period of up to 4 years — the more AERO you lock and the longer you lock it for, the higher your voting weight. Upon locking, you get a veAERO “Lock” (also known as a veNFT). This NFT represents your voting weight and can be used to participate in votes each week.

So far we haven’t yet seen big volume on the wXCH/USDC pair so earned transaction fees are not that high. Hence most of the incentive to voters right now come from the aforementioned manual incentives — that’s Level 4.

Level 4: Manual incentives (“bribes”) to kick start the liquidity pool

AMMs can suffer from a chicken-and-egg problem where users don’t use it if there isn’t liquidity, but liquidity isn’t provided because there’s not enough volume to generate fees to offset risk of impermanent loss. The way Aerodrome solves this is by allowing anyone to kick start a pool by artificially injecting incentives, known as “bribes”.

Michael Taylor (former contractor for Chia Network working on DataLayer and CADTrust) has done exactly that out of his own pocket.

- He put in over $10K in voting incentives (Level 4).

- This encourages users to put their voting weight towards the wXCH/USDC pool (Level 3).

- This incentivizes liquidity by increasing AERO rewards allocated to liquidity providers of wXCH/USDC (Level 2).

- Higher liquidity leads to lower slippage and encourages users to use Aerodrome for swapping (Level 1)

- More users creates more swap volume and fees to go back to voters (Level 3). This hopefully creates a sustainable feedback loop without requiring ongoing injection of bribes.

Editor’s note: If anyone wants to help out Michael with his out of pocket contributions, consider sending to him at xch18v9mwuge0cve5qsaty3aulmpklt5rdmvxuutfw20mh8uk49rhq8syuxher

Michael also separately pointed his existing veAERO voting weight towards the wXCH/USDC pool, further increasing the APR at Level 2 at his own expense. He has declared a goal of achieving $1M TVL on this pool and is already more than halfway there in less than a week!

Bonus: Automate weekly voting by locking into the Chia Relay

To streamline and automate the process of voting (Level 3), there’s a mechanism to delegate your votes so you don’t need to worry about voting each week: Aerodrome Relays. You can pledge your veNFT into a Relay and each week your voting and claiming strategy will simply follow the set up of the Relay.

For example, the Chia Relay will put your voting weight towards incentivizing wXCH/USDC each week. It is also set up to compound any voting rewards into more veAERO to grow your voting power.

Relays create a structural support for liquidity pools, by locking AERO long term to establish a sustainable floor on the amount of yield offered to liquidity providers.

Aerodrome Flight School

Aerodrome has a launch incentive program for new pools and is currently giving bonus AERO to newly locked veAERO that votes for the pool as well as bonus AERO to the Chia Relay owner (Michael) to put towards the Chia Relay.

The time is now for the community to rally and create a strong foundation for this important gateway for XCH.

What are the risks?

It’s easy to look at the APR and draw connections to past DeFi failures like LUNA and Celsius. I hope this primer provides transparency in how it works and where the yield is coming from. An important risk to call out with engaging at any level are potential issues with the bridge, either on the Eth/Base contract side, or the Chialisp smart coin side.

Providing liquidity also has risk of impermanent loss, which is not always well understood by liquidity providers. This Impermanent Loss Calculator can help map out scenarios of what could happen.

Thoughts and conclusions

Much of the success of this liquidity pool is attributed to Michael Taylor’s generous incentives to kick start its use, as well as his public push for more of the Chia community to adopt Aerodrome. None of this would be possible either without the work of @yakuh1t0 and the warp.green team to make bridging assets a reality.

Ultimately success will be defined by usage of Aerodrome as an on-ramp and off-ramp for XCH to USDC. At present, it is already far more liquid and a better gateway than many swap services and even centralized exchanges. Time will tell if the community can come together to pledge enough to the Chia Relay to create enough permanent incentive to maintain $1M TVL in the pool.

My other concluding thought is to think about how we can replicate similar success within the Chia ecosystem. TibetSwap and Dexie are excellent marketplaces that utilize the full capabilities of Chialisp to do decentralized Offers based settlement, however they have not seen the liquidity required to be scalable gateway for XCH.

Dexie’s recent testnet governance vote is a promising step in that direction though providing liquidity on Dexie today is still not accessible to many users. Providing liquidity on TibetSwap is easier but there isn’t an incentive mechanism to encourage it. I have some ideas on how to bridge these gaps but would love to hear your thoughts as well.

[…] “Building Liquidity for XCH: A Primer on Aerodrome” […]