Last year I gave my Top 10 Chia Predictions for 2025 and recently published a look back on those predictions. This year I’m taking a more conservative approach to give a wider variety of predictions rather than making half of my predictions predicated on a single product.

That said, I think 2026 will be a pivotal year for Chia. Here are the top 10 things I’m predicting will happen this year for the Chia blockchain and ecosystem.

Personal opinion follows, not financial advice. Let me know your thoughts!

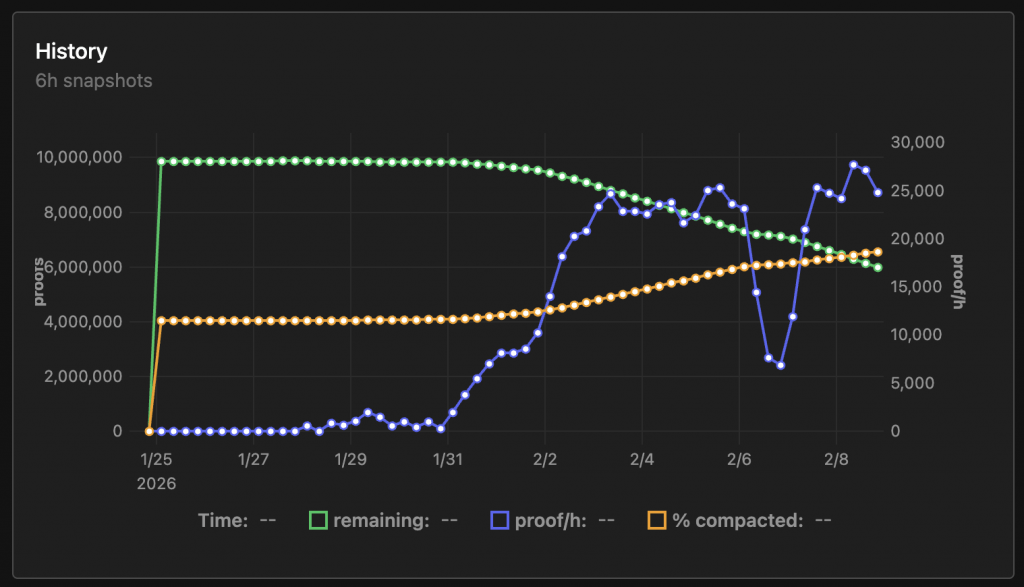

#10 The blockchain gets fully compact

I recently wrote about WesoForge, the project that’s gamifying blockchain compaction through Bluebox Timelords. Despite recent Proofs of Time from ASIC timelords being much more difficult to compact, WesoForge creator Eal released an updated v1.1.0 of his software which can compact historic blocks in batch groups.

At this pace, fully compacting historic blocks seems almost guaranteed within the next month. The real question will be whether we’ll see continued Blueboxing efforts after the chain is fully compact. As new blocks come in, it becomes a head-to-head competition for $Weso rewards and this may deter casual community participants.

#9 PoS2 hard fork is accepted as farmers start replot

The new Proof of Space 2.0 format has been in development for almost two years now, and 2026 feels like the year it finally crosses the finish line and farmers start to replot. Additionally, with Chia Network’s recent announced purchase agreement with NoSSD, the risk of the hard fork not being accepted has gone down significantly.

I’m predicting the official PoS2 CHIP will be published, discussed, and implemented in the future Chia 3.0 release as farmers begin their replot some time this year. I also think the transition period will kick off this year but may not finish until 2027 — that is, I think existing plots will be farmable until 2027.

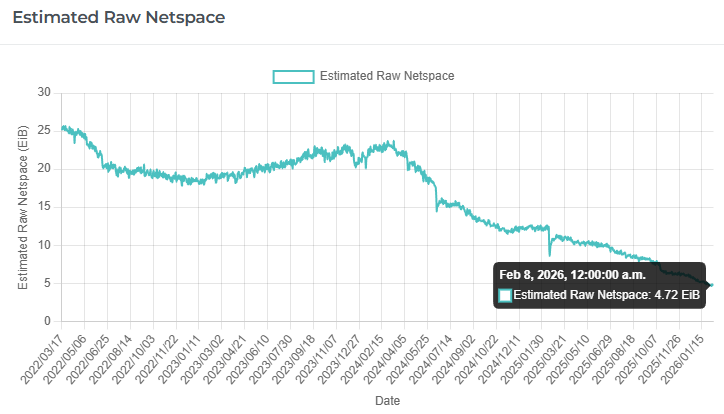

#8 Raw netspace touches a yearly low of 3EiB

The Chia netspace has been on a general decline over the past year and is currently sitting around 7 EiB of effective netspace which translates to an estimated 4.7 EiB of raw netspace (Source: XCH.farm). The recent rise in storage pricing also puts pressure on netspace as farmers may find it more financially sound to sell their used drives rather than farm with them. This, in addition to the natural churn from low coin price and farmers taking drives offline to replot later this year, I predict we’ll see the netspace dip below 3 EiB of raw netspace at some point in 2026.

That being said, I also expect a turn around in netspace with the new plot format drawing interest from new and returning farmers. By the end of the year the raw netspace could recover back to 6-7 EiB.

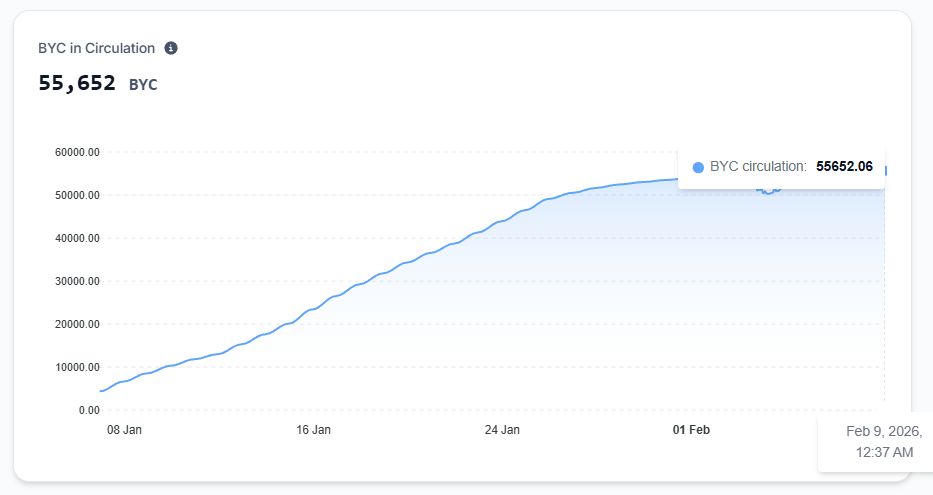

#7 Over $500K of BYC gets minted

CircuitDAO‘s Bytecash (BYC), the over-collateralized stablecoin backed by XCH, is still young with only 55,000 BYC minted at time of writing. But I predict 2026 will be a year of growth as the community gets more comfortable with the protocol and it moves out of beta. That’s roughly a 9x from current levels — ambitious but achievable especially if there are more uses for BYC like the recent Silicon.net pre-deposit program.

#6 More puzzles published in Rue than Chialisp

Rue, the Rust-like programming language was created by Rigidity as an alternative to Chialisp for writing smart coin puzzles. A more intuitive and familiar syntax coupled with decent docs and tooling could lower the barrier for developers (and LLMs) to build with the language.

This might be niche but I predict that in 2026, there will be more novel smart coin puzzles in CHIPs published written in Rue rather than Chialisp.

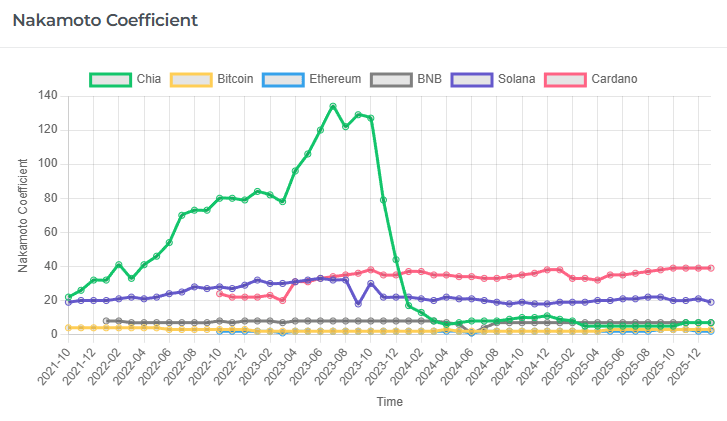

#5 Nakamoto Coefficient recovers above 20

The Nakamoto Coefficient, a measure of decentralization, has been disappointingly low in recent years. It is currently sitting in the single digits and far from Chia’s historic industry-leading highs of 100+.

I predict 2026 will see NC recover above 20 putting it squarely ahead of many well known blockchains. Although NC of 20 is still conservative compared to Chia’s peak, it would signal a meaningful step in the right direction.

#4 Chia gets increased media mentions

We’ve seen some mainstream media interviews and articles relating to Chia and Permuto this past year. Between new financial products and continuing to be the infrastructure supporting global carbon transparency, I’m predicting that amount of coverage will increase in 2026 and specifically from outlets outside the crypto industry.

#3 XCH gets a major exchange listing

In 2024, I correctly predicted that neither Coinbase nor Binance would list XCH.

In 2025, I incorrectly predicted that both Coinbase and Binance would list XCH.

For 2026, I’ll hedge with an in-between prediction that XCH will get listed on Coinbase or Binance. What would it take for this to happen? Read my thoughts on Why Isn’t XCH Listed on Coinbase Yet.

#2 Prefarm sales slow down significantly

One way or another, I expect prefarm sales to slow down. Whether it is due to increased Buy XCH with ACH volume, cost cutting, or significant revenue generation via Permuto and/or paying customers, I predict prefarm sales (in fiat terms) for the sake of funding operating costs will slow down significantly though not necessarily stop completely.

More to come on this in a future article.

Honorable Mention: Community dApps launches

The Chia community (and especially Yakuhito) has been quietly working on important projects that have yet to launch, including:

- XCHandles – Decentralized address book

- DIG.net – Decentralized content delivery

- CATalog – Decentralized CAT registry

- TibetSwap v3 – Decentralized AMM with CAT-CAT pairs and concentrated liquidity pools

- … and more

Some of these are already in testing or early access, but I’m predicting full public launches of at least 2 of these dApps this year.

#1 Permuto launches at least one AC/DC trust

This is the big one. Permuto’s launch was delayed by the SEC asking the team to switch from being a 33-act filer to a 40-act filer. As Gene shared in an interview last year, this was an unexpected last minute change but does come with interesting implications such as allowing similar trusts for ETFs or even smaller companies with a blockchain-only offering.

Given the exemptive relief required from the SEC before the S-6 can be filed, we haven’t actually seen the S-6 yet but in the meantime, Permuto has been working on readying the Permuto App and exploring other product offerings which may end up trading before AC/DCs.

Ultimately, I predict that Permuto will successfully launch at least one AC/DC trust this year. I also think it’s possible that the resulting trust structure and AC/DC product may look different from what was presented in the S-1. For example, I could imagine a different fee structure, different restrictions for deposits and/or trading, changing requirements for reporting, or even initially forgoing either the national exchange or blockchain for a simpler launch.

Let’s see what happens!

Conclusion

And just as last year, I won’t give a prediction of XCH price. How the totality of the above predictions translate to block space demand and XCH price is left as an exercise to the reader.

What do you think of my predictions? Did I miss something? Let me know in the comments!