Last year I gave my Top 10 Chia Predictions for 2024 and recently published a look back on those predictions. 2025 is gearing up to be an exciting year for Chia, kicking off with the January announcement and I think it will exceed already high expectations. Here are the top 10 things I’m predicting will happen in 2025 for the Chia blockchain and ecosystem.

Personal opinion follows, not financial advice. Let me know your thoughts in the comments.

#10 Chia will not get native Circle USD (USDC) or Tether USD (USDT) in 2025

The most popular stablecoin on Chia is a wrapped version of Circle USD (USDC) through the warp.green bridge. Specifically, the Base version (wUSDC.b) currently has the most liquidity.

I predict that Chia will not get native USDC or USDT issued on-chain in 2025 although the technical requirements are coming together. I also predict CircuitDAO v1 to launch in 2025 and the over-collateralized stablecoin Bytecash (BYC) start getting issued and used.

However, I still expect wUSDC.b to be the dominant stablecoin in Chia, at least until CircuitDAO v2 is available and other assets (specifically RWAs) can be used as collateral to mint BYC. I also predict liquid stablecoin markets to emerge to easily move between different stablecoins with minimal spread.

#9 New plot format released but replotting won’t start in 2025

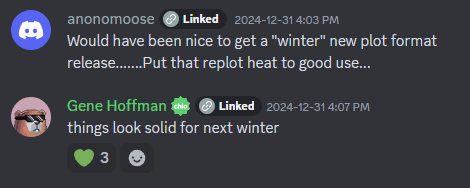

We saw a big update on the new Proof of Space format (and hence new plot format) a month ago. We’re anticipating an official CHIP to be released in Q1 2025 that will establish hard fork and replot timelines. I predict the CHIP itself will be rife with discussion on the timelines and incentives for replotting. As a result, I don’t expect agreement and broad support on the CHIP to be reached quickly and I predict replotting to the new format will not start in 2025, despite Gene’s optimism.

Related, I predict the Nakamoto Coefficient will remain under 20 this year, which is a sufficient and respectable number in crypto but a disappointing number for Chia given historic highs of 100+.

#8 Chia Gaming proves out state channels but doesn’t get traction

Bram has been working on Chia Gaming for over a year now and it is getting close to launch. The gaming aspect was always meant to be a motivating use-case to prove out the design of L2 state channels but it also created potential to drive peer-to-peer gaming activity and block space usage.

I predict it will launch as expected and some will try out the games but it won’t gain long term traction due to the quirks (compromises) of the games’ rules and a lack of a user friendly front-end for match making at launch. Remember ChiaTCG?

As a state channel proof-of-concept, it will be a good reference necessary for institutions to be comfortable with the feasibility of future scaling but I also don’t predict any L2s to be built and launched around this design in 2025.

#7 Many DeFi primitives get built but won’t be widely used

There are a number of items on the official roadmap that will are important building blocks for DeFi and markets to run efficiently. These include things such as:

- Options puzzles

- Partial offers

- Limit orders

- Multiple offers

- Marketplace fees on offers

I do think these will be delivered (in fact, the first on-chain options contract was already sold), but I predict most will just be proof-of-concepts at this point with few seeing broad usage in 2025.

#6 Prefarm sales stop in 2025 but it will be leveraged for other purposes

The strategic reserve was leveraged extensively to “keep the lights on” in 2024 (you can view the activity on XCH.ninja). I predict the prefarm sales to continue into the beginning of 2025 but will officially cease before the end of the year as other revenue streams ramp up and mature.

Some of the prefarm was also used for seed investments in 2024 into Berkeley Compute and SpaceTime. I would not be surprised to hear about more investments in 2025 to diversify the company’s balance sheet. Other potential uses include providing more loans for market making liquidity and supporting ecosystem development, but with intentional ad-hoc investments as opposed to a formal grant program.

There has also been mention of XCH “buy-backs” to replenish the prefarm but I don’t anticipate this happening in 2025, and certainly not before an IPO.

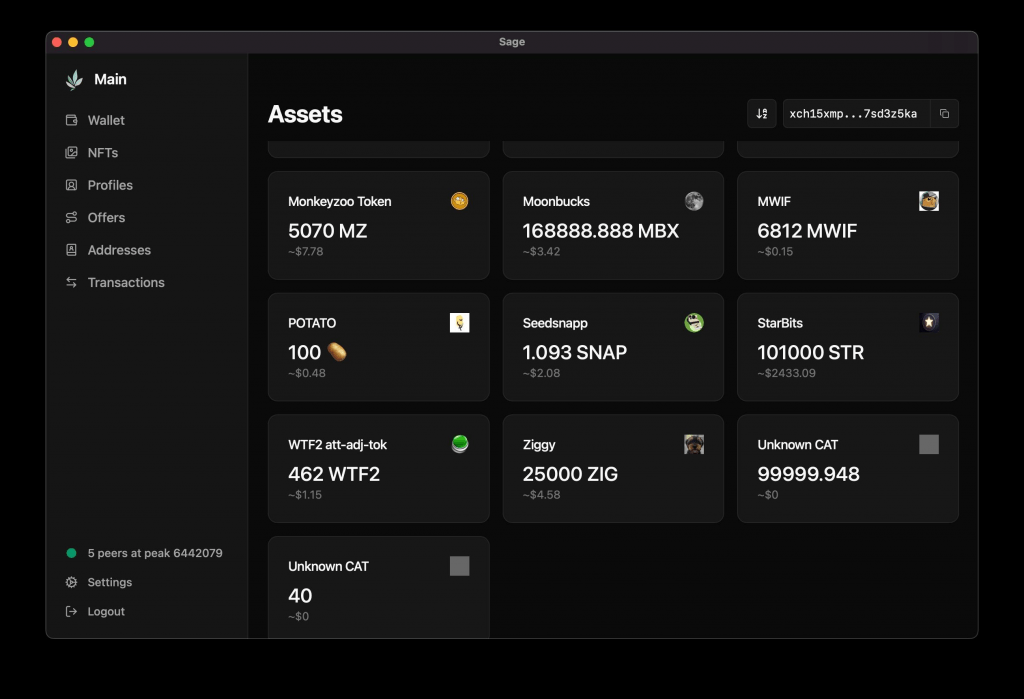

#5 Sage Wallet becomes the premier Chia wallet; Cloud Wallet gets niche use

Continuing on my prediction last year about retail struggling to understand the importance of the iOS Signer (now known as the Chia Signer), I think the concept of vaults and secure signers will fall on deaf ears with retail.

There will certainly be a niche (power users, whales, enterprises) that will benefit from the functionality and vault support of the Cloud Wallet but I predict the vast majority of new users will opt for the cross-platform Sage Wallet in 2025. This is not because Sage Wallet is strictly better than the Cloud Wallet (they serve different purposes) but because it is fast, feature packed, and provides an experience that retail is already familiar with.

Shoutout to Rigidity for building an awesome wallet and constantly iterating to make it better. It has already become my main wallet for regular use.

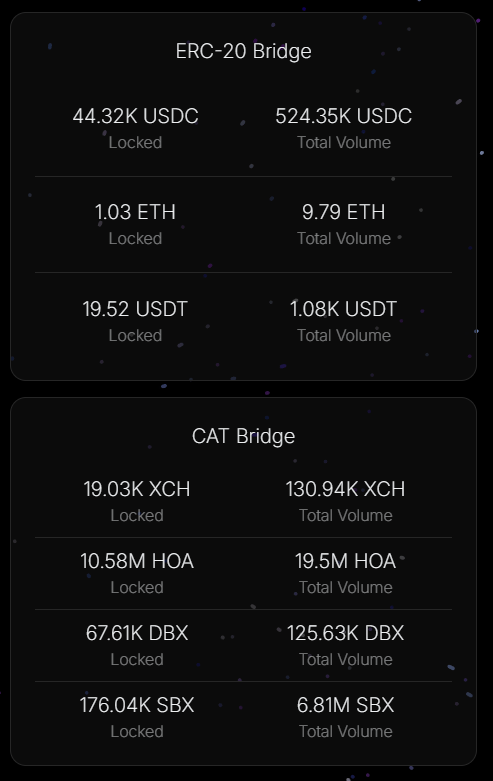

#4 warp.green sees more than $100M in bridge volume

Since the launch of the warp.green bridge earlier in 2024, over $3.5M in volume has been bridged between ETH/Base and Chia. With the anticipation of significant real world assets (see prediction #1) and the needed stablecoin liquidity to trade them, I predict the total bridge volume to surpass $100M in 2025.

At 0.3% fees, this would also imply over $300K in protocol fees split amongst the 11 bridge validators.

#3 XCH gets listed on both Coinbase and Binance

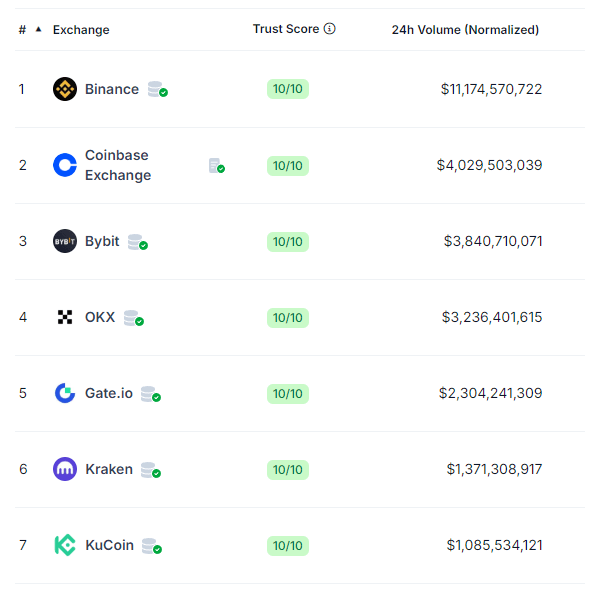

I correctly predicted that the two largest CEXs would not list XCH in 2024 (and wrote about the reasons why) but I will go out on a limb and predict both exchanges will list XCH in 2025.

#2 CNI will IPO in 2025

Between sustainable revenue streams, a more favorable administration, an apparently smooth SEC review process, and improving market conditions, it seems the stars are aligning for an IPO for Chia Network Inc. I predict an official public S-1 filing followed shortly by an IPO in 2025 — keep an eye on EDGAR.

The S-1 document itself should be very interesting to dive into and can shed light on how the company navigated the past several years. I’m also curious to learn more details about how early farmers can take part in the IPO process.

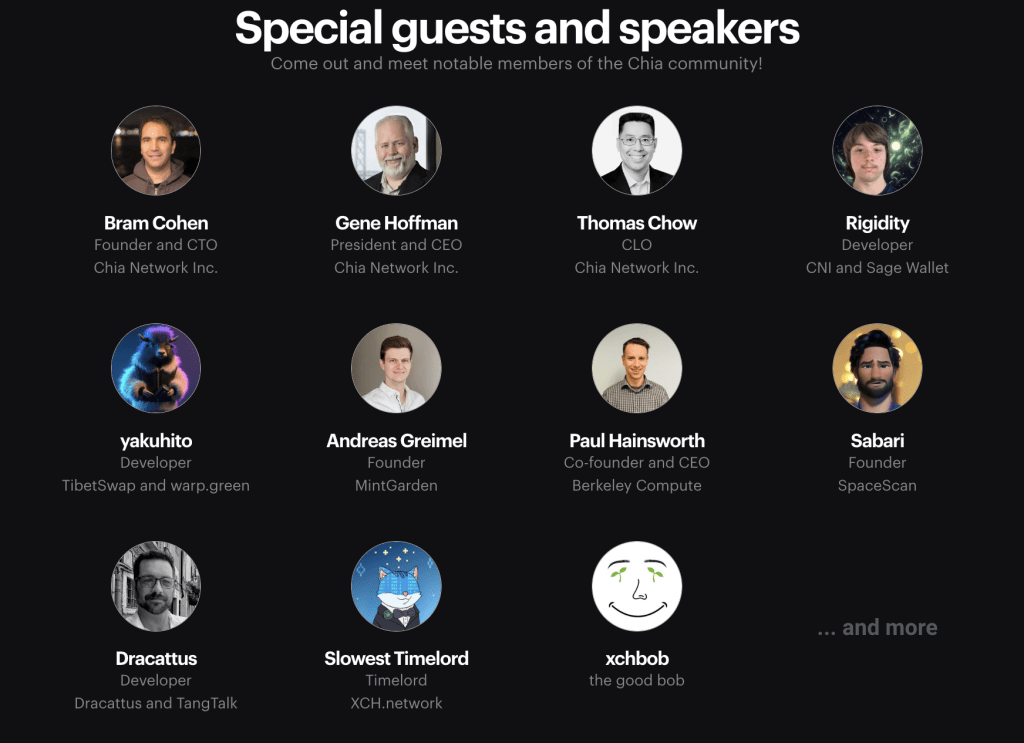

Honorable Mention: Chia Toronto 2025 will be the biggest in-person Chia event to date

There have been several hotspots for Chia in-person meet ups over the years (San Francisco, Hong Kong, London) but I predict this year’s Chia Toronto event in May will be the biggest one yet!

With this many special guests and speakers, it surely won’t disappoint. Check out the website and keep an eye out for registrations opening!

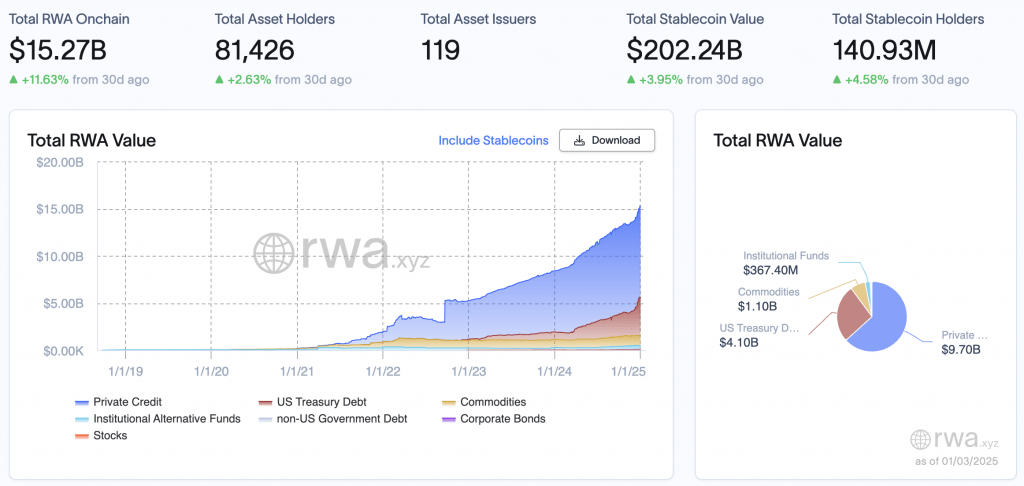

#1 Chia will be home to the majority of RWAs in crypto

At time of writing, the size of the Real World Assets market (excluding stablecoins) as tracked on RWA.xyz is $15 billion (USD), consisting mostly of tokenized private credit and U.S. Treasury debt. Currently, over 80% of these RWAs are on Ethereum and related L2s.

As a direct outcome of the upcoming January announcement, I predict that by the end of 2025 the Chia blockchain will be home to the vast majority of non-stablecoin RWAs in crypto, meaning at least $15B worth of RWAs tokenized on the Chia blockchain.

Caveat: RWA.xyz does not have all blockchains integrated and tracked, for example it doesn’t include Bitcoin RWAs. It also does not (and may not) integrate the Chia blockchain so the outcome of this prediction may not be evident on the RWA.xyz dashboard.

Summary and what does this mean for Chia?

- #10 Chia will not get native Circle USD (USDC) or Tether USD (USDT) in 2025

- #9 New plot format released but replotting won’t start in 2025

- #8 Chia Gaming proves out state channels but doesn’t get traction

- #7 Many DeFi primitives get built but won’t be widely used

- #6 Prefarm sales stop in 2025 but it will be leveraged for other purposes

- #5 Sage Wallet becomes the premier Chia wallet; Cloud Wallet gets niche use

- #4 warp.green sees more than $100M in bridge volume

- #3 XCH gets listed on both Coinbase and Binance

- #2 CNI will IPO in 2025

- Honorable mention: Chia Toronto 2025 will be the biggest in-person Chia event to date

- #1 Chia will be home to the majority of RWAs in crypto

I think it will be a significant year for Chia, a year where it gains mainstream recognition and proves beyond a shadow of a doubt the value of a decentralized and programmable blockchain ledger.

As for XCH, I won’t give a prediction of XCH price. Crypto markets are volatile and often times irrational. I would defer to Chia’s blog post Cypherpunks in Sportcoats: The Fundamental Value of Cryptocurrencies and Blockchains that explains where actual value of XCH comes from — block space access. Exactly how the totality of the above predictions translate to block space demand and XCH price is left as an exercise to the reader.

What do you think of my predictions? Did I miss something? Let me know in the comments!