Last month, Chia Network in partnership with EcoRegistry tokenized and made available high quality carbon credits that can be purchased, traded, and ultimately retired entirely on the Chia blockchain by anyone, anytime, anywhere.

This emergence of an end-to-end carbon market was my top Chia prediction for 2024 and marks a significant milestone in Chia’s goal towards their One Market vision that has important implications for the growth of the project. Let me explain.

Didn’t we already have this?

The first verifiably carbon offset transaction and retirement on Chia and CAD Trust was back in April 2023. This was a proof of concept that demonstrated the tools are in place to at least manually issue, trade, track, and ultimately retire a carbon offset on the Chia blockchain.

What was missing was scaling, automation, and accessibility of this market to the public. Now we have all that.

What was actually announced?

The blog post, “From Carbon Market to One Market” from Chia Network announces the partnership and how it ties into the One Market vision. There is also a follow up post with instructions on how to actually engage with the carbon credits but there are a few important pieces that weren’t mentioned.

In order to appreciate what was announced, let’s examine the life cycle of a carbon credit.

- A carbon offset project is started (e.g. reforestation, carbon capture, etc.)

- A carbon registry (e.g. EcoRegistry, Verra, etc.) verifies the validity, quantity, and quality of the project.

- Carbon credits are issued by the registry, enforcing established standards for the definition of an effective ton of carbon dioxide (tCO2e).

- Carbon credits are purchased by interested parties to offset their emissions for ethical and/or regulatory reasons.

- Carbon credits are retired and taken out of circulation.

CAD Trust was developed as a means to track all these steps on the Chia blockchain, allowing transparency for projects, registries, buyers, and auditors to ensure there is accurate assessment and no double counting of credits.

In the past, individuals and companies interested in voluntarily offsetting their emissions needed to engage an intermediary with access to private markets to facilitate steps 4 and 5. Now, this can be done by anyone on the Chia Blockchain and have verifiable proof to show auditors, regulators, and institutions for tax credits or other benefits.

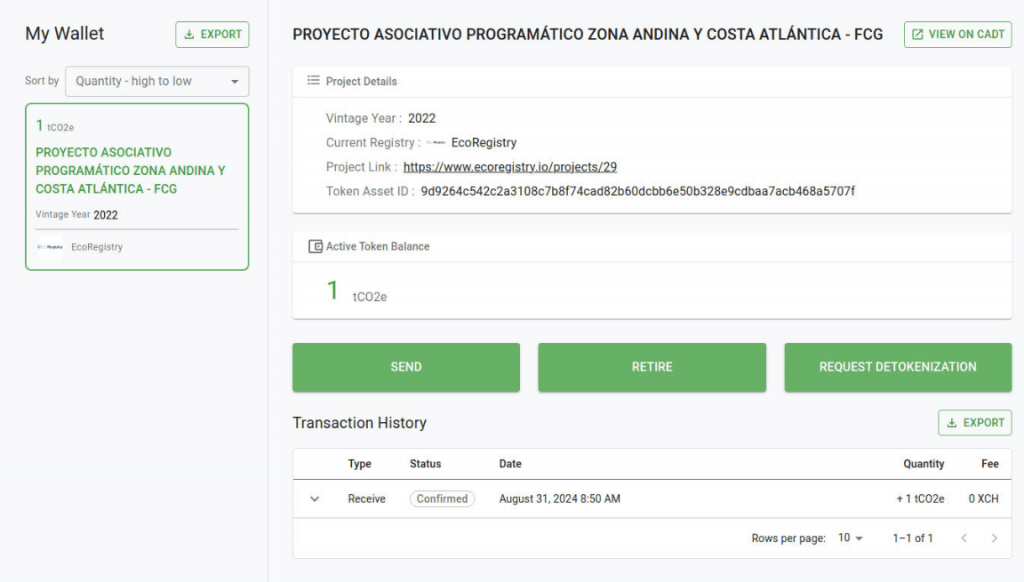

Let’s see a real example of how I was able to offset the annual carbon emissions of the server infrastructure hosting my XCH.network of sites.

A real example for XCH.network

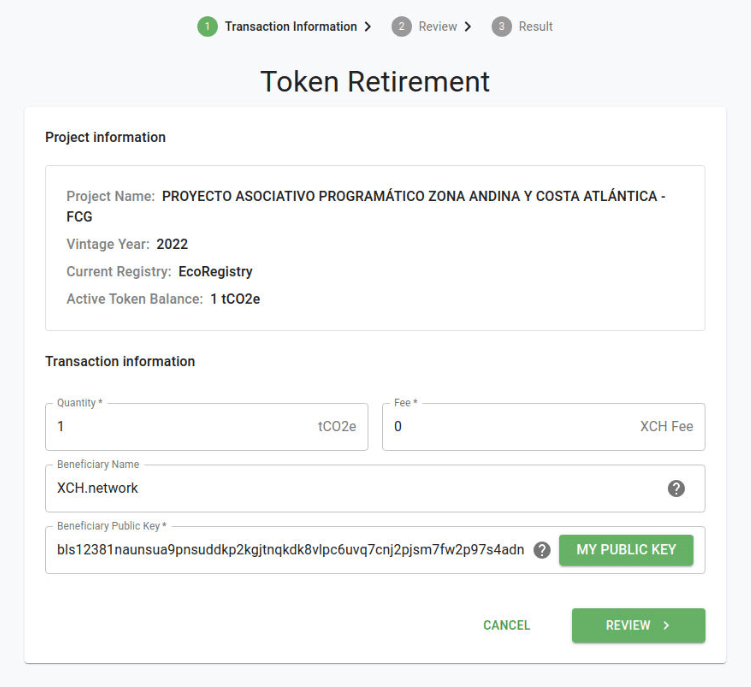

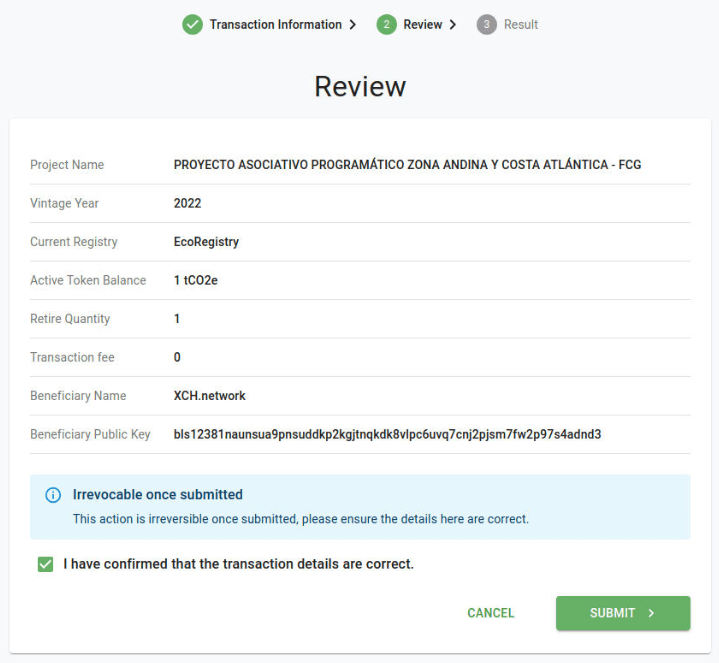

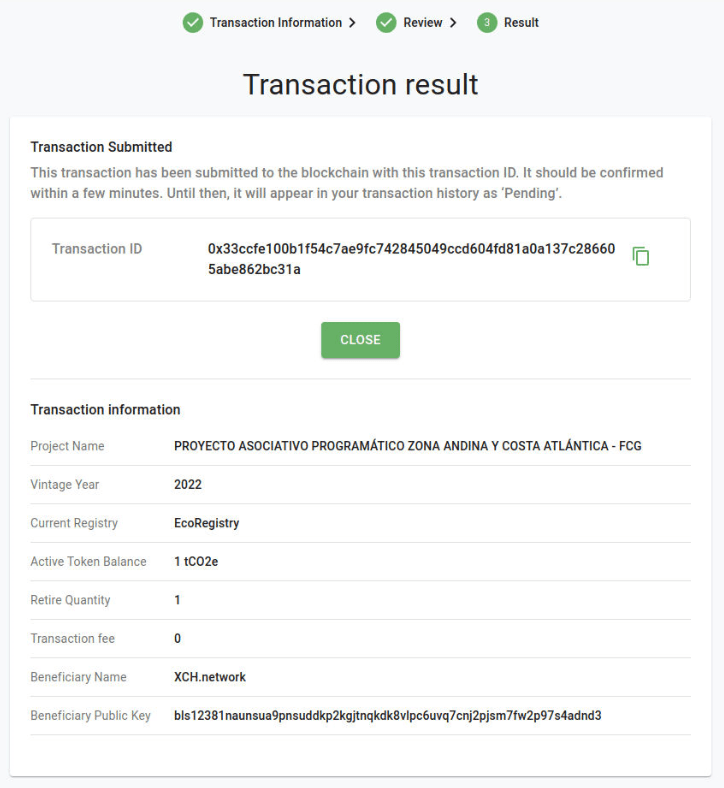

I navigated to carbon page on dexie that displays available projects that have tokenized carbon credits. I purchased one and loaded up the Climate Wallet. From here I retired the token on-chain attaching my BLS public key and “XCH.network” as the beneficiary.

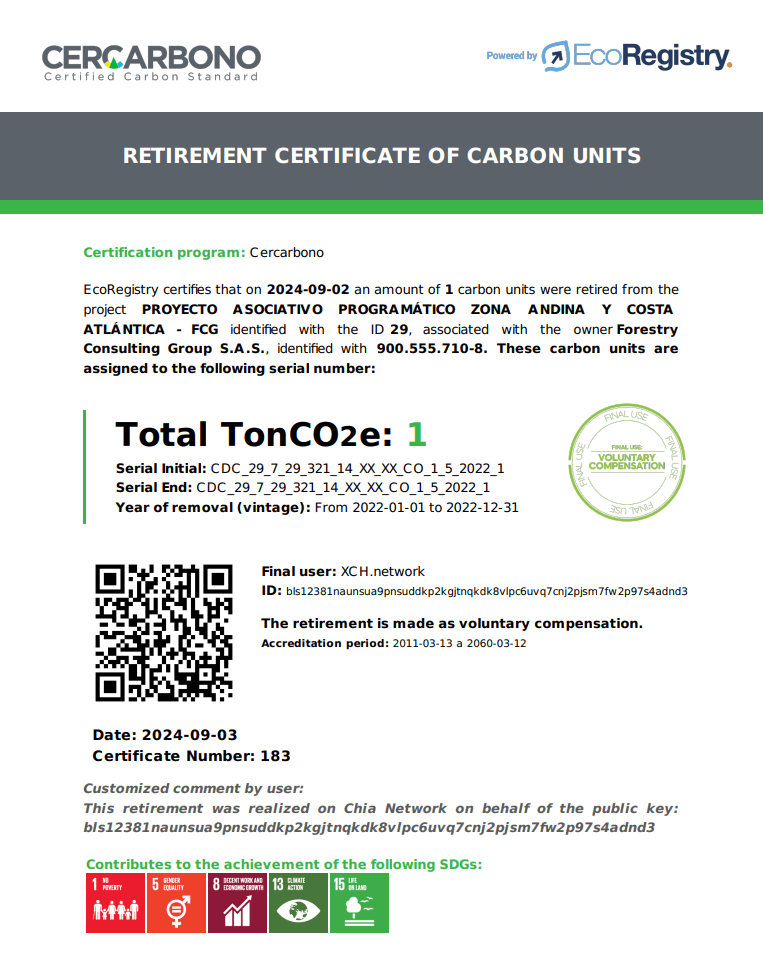

Once the retirement has happened, the token itself can no longer be spent or retired again and most importantly, EcoRegistry monitors the blockchain to reflect this retirement in CAD Trust and issues a retirement certificate that can be found on the respective project page.

With this certificate and (the corresponding CADT data to verify its authenticity), I now have proof that I purchased and retired the equivalent of one ton of carbon. This proof may be useful in applying for tax credits (if applicable), or simply serving as evidence to others that I have done my part to offset my carbon footprint.

What implications are there for Chia?

Regardless of what one may think about carbon markets and their effectiveness in combatting climate change, there are important technical implications that this emerging market on Chia demonstrates and can pave the road for further use cases.

Real world assets can be effectively tokenized and traded on Chia

The CAT2 standard for asset token issuance on Chia was designed to be flexible enough for real world use cases. Though it has mainly been used for meme coins thus far, the flexibility of the CAT TAIL allows for different issuance schemes and token life cycle structures. The approach to do individual CATs per carbon project demonstrates the scalability of this design and provides arguably the single most useful real world application in the entirety of the blockchain industry.

The coinset model and Chialisp works

A common criticism of Chia is its choice of a UTXO/Coinset model and Chialisp as the on-chain programming language. Although the learning curve is steeper than the likes of Solidity and account model on Ethereum, the security and scalability benefits of coinset and Chialisp are clear. Now that we have numerous examples demonstrating complex applications (AMMs, NFTs, liquid markets, DAOs etc.) can be securely built on Chia, this criticism holds less and less water.

Marketplaces are important, but optional

Dexie has done a great job consolidating carbon tokens into an easily discoverable way but this is optional convenience for end users. Underlying Offer Files are actually submitted to the decentralized Splash! protocol so users looking to automate trading of these tokens do not need to rely on any central service like dexie to operate.

(Also check out Splash Terminal for a user friendly way to visualize the Splash! network)

Offer Files can create a liquid market with auto-expiry

The Offer Files posted for the tokenized carbon credits are created entirely offline with have auto-expiry after a certain number of blocks. By not requiring an on-chain transaction until offer acceptance, this allows the trader to price their offers dynamically, responding to external factors like volatile token prices and market action, mimicking a familiar high frequency order book common on centralized exchanges.

Tokens can be efficiently priced in either stablecoin or XCH

Leveraging auto-expiry, carbon credits are listed for sale in both wUSDC/wUSDC.b and XCH. This demonstrates both a functioning stablecoin equivalent (in wrapped USDC), and the fact that a liquid market can be effectively created against a volatile asset (XCH).

What’s next?

More RWAs

I’m expecting more real world assets to be tokenized on Chia in the future, including more complex assets like stocks and other securities. These will require a verifiable credential (VC) issuer to be onboarded and make use of credential restricted CATS (CR-CATs) but the rest of the infrastructure is already in place to support such a market as a result of building out the carbon market.

Easier UX for non-Chia users to buy and retire carbon

As powerful as this new market is, there are still major UX hurdles to overcome, especially for newcomers to Chia. For one, acquiring wUSDC or XCH requires multiple steps including setting up a Chia wallet and learning how to use the warp.green bridge. It also requires installing a separate Climate Wallet and learn blockchain specific terminology (e.g. “Offers”, “BLS keys”, “CATs”) throughout the process.

There’s a ripe business opportunity here to streamline several of these steps as a service.

There has not been much publicity or marketing of this carbon market outside the Chia ecosystem, but I don’t think such efforts will be effective until the UX is also made easier.

Growth of carbon activity on Chia

CAD Trust currently tracks over 85% of the voluntary carbon market. With a couple more key registries such as Gold Standard to onboard, it will effectively track the entire market. Tokenization volume should continue to increase on Chia since it has the least amount of friction for registries.

Businesses will be increasingly required by international and local regulation to offset their emissions which will create more demand for carbon credits. Chia becomes a natural (and currently only) accessible choice for “retail” to speculate on carbon credits if they believe the price of carbon will go up.

Conclusion

Chia is now the home to the first global and publicly accessible carbon market. The technologies demonstrated in creating this market paves the road for more real world assets to be tokenized on Chia, ultimately creating One Market for all sorts of digital tokens to be traded securely and efficiently 24 hours a day 365 days a year.