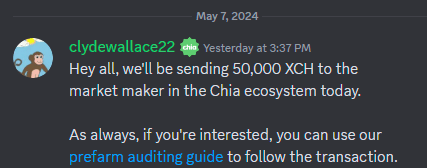

Announcement

It was announced on Discord yesterday that Chia Network has sent another round of 50,000 XCH from the prefarm (Strategic Reserve) to their engaged market maker.

After this sixth round, the amount transferred to the market maker totals 450,000 XCH, consisting of both loans and amounts to be sold on behalf of CNI.

Blockchain Analysis

To recap the prefarm movements:

- Oct 13, 2023 (200,000 XCH): Chia Network Provides Loan to Market Maker

- Dec 7, 2023 (50,000 XCH): Update: Chia Network Makes Second Transfer to Market Maker

- Feb 1, 2024 (50,000 XCH): Chia Network Sends Third Round of XCH from Strategic Reserve to Market Maker

- Mar 20, 2024 (50,000 XCH)

- April 3, 2024 (50,000 XCH)

- May 7, 2024 (50,000 XCH)

Note: there was also a transfer of 47,872 XCH to a marketing partner on April 3, 2024 — maybe a topic for a future post.

As with previous transactions from the prefarm vaults, any spends from the US or Swiss warm wallets is met with a 24 hour clawback period. The initial move of 50,000 XCH into a clawback coin happened at May 7, 2024 19:34:13 UTC, and the sweep to its final destination happened almost exactly 24 hours later at May 8, 2024 19:42:12 UTC. As of time of this article, the market maker has not made further moves of this 50,000 XCH.

Interestingly, the destination address xch1wek...9tk3 is different than one used in the last 3 transfers that were swept into xch13x0...26ja, and different from the one used in the first 2. This is the third distinct address used by the market maker to receive transfers.

Purpose of Transfer

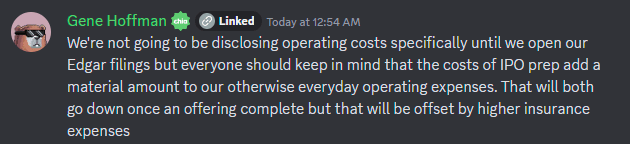

As we heard in the recent Chia in China AMA, Gene confirmed that of the first 300,000 XCH sent to the market maker, ~100,000 XCH were a loan and ~200,000 XCH was marked for sale on behalf of CNI. It would not be a stretch to assume most, if not all, of the subsequent 50,000 XCH transfers were also marked for sale on behalf of CNI to fund ongoing operations.

Continued sales of 50,000 XCH every month would imply a runway of 3.5 years with just the warm wallets alone (1/8th of the prefarm), though Gene’s comment about material added expenses for IPO prep means we shouldn’t expect a consistent pace of sales, and the on-chain data would tend to suggest this.

To understand the actual pattern of sales, we can look at the fourth and fifth transfers to trace the subsequent coin spends.

Examining potential prefarm sale patterns

I’ll forgo the coin lineage chart for this as it gets unwieldly very quickly but from the fourth and fifth transfers, the subsequent spends have a fairly regular pattern sending to familiar addresses (potentially centralized exchange deposit addresses) observed in the first transfer.

| Date | Amount | Destination |

| Mar 25 2024 | 10000 XCH | xch1…de2v |

| Apr 8 2024 | 10000 XCH | xch1…de2v |

| 10000 XCH | xch1…4ld5 | |

| Apr 15 2024 | 10000 XCH * | xch1…de2v |

| 4999 XCH | xch1…4ld5 | |

| Apr 26 2024 | 10000 XCH | xch1…de2v |

| 5000 XCH | xch1…4ld5 | |

| Apr 30 2024 | 3500 XCH | xch1…de2v |

| 3500 XCH | xch1…4ld5 | |

| May 8 2024 | 10000 XCH | xch1…de2v |

| 5000 XCH | xch1…4ld5 | |

| 5000 XCH | xch1…0ugu |

* On Apr 15 2024, ~55000 XCH from another address that includes the 5th transfer was combined into this chain of spends which would align with Gene’s comment possibly insinuating a higher recent sale velocity.

From the on-chain data, there’s no way to know for certain what the purposes of each transfer might be but my interpretation is that the sales by the market maker are happening in smaller increments on two primary centralized exchanges, and recently a third as well.

Follow me on X @SlowestTimelord or follow XCH.today for further updates on market maker and prefarm movements. You can also track the prefarm yourself.

[…] article “Chia Network Sends Sixth Round of XCH from Strategic Reserve to Market Maker” over […]

[…] May 7, 2024 (50,000 XCH sold): Chia Network Sends Sixth Round of XCH from Strategic Reserve to Market Maker […]