Peer-to-Peer is a series of Q&A style interviews with members of the Chia community. This interview is with the CircuitDAO team behind Circuit, the decentralized, over-collateralized stablecoin protocol built natively on the Chia blockchain.

The Chia ecosystem has been lacking a resilient and trustless native stablecoin. CircuitDAO answers this call with Bytecash (BYC), a stablecoin minted by users against their own XCH. By utilizing Chialisp-powered smart contracts, the protocol aims to provide the foundational functions necessary for a thriving DeFi landscape on Chia without relying on centralized stablecoin providers

- Twitter:@Circuit_DAO

- Website:https://circuitdao.com/

- Documentation:https://docs.circuitdao.com/

- Discord

Thank you for taking time to chat today. First of all, for those in the Chia community who aren’t familiar with Circuit or similar CDP protocols on other chains like MakerDAO, can you describe the functionality you’ve built and how the community can use it?

A collateralized debt position (CDP) protocol allows users to lock up collateral in a smart contract and borrow stablecoin against it. In the case of Circuit, the collateral asset is XCH. The stablecoin, Bytecash (BYC), is natively issued by the protocol and pegged to the US Dollar. Users that borrow Bytecash have to pay interest to the protocol upon repayment of their loans.

The protocol also comes with savings vaults that users can deposit Bytecash into to earn yield.

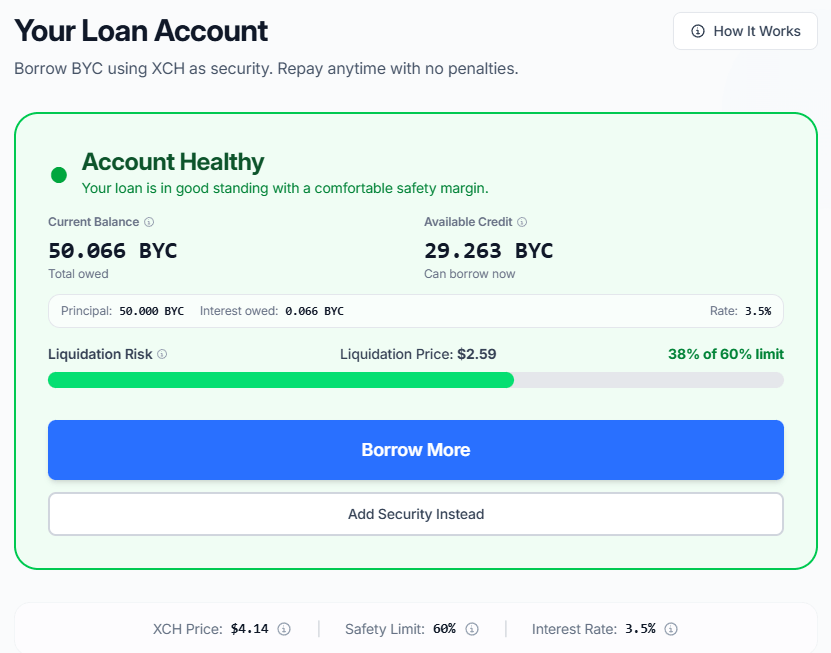

Editor’s note: At the time of writing, the interest on loans is 3.5% APR and the yield on deposits is 3.2% APR. Always check https://circuitdao.com/ for latest rates.

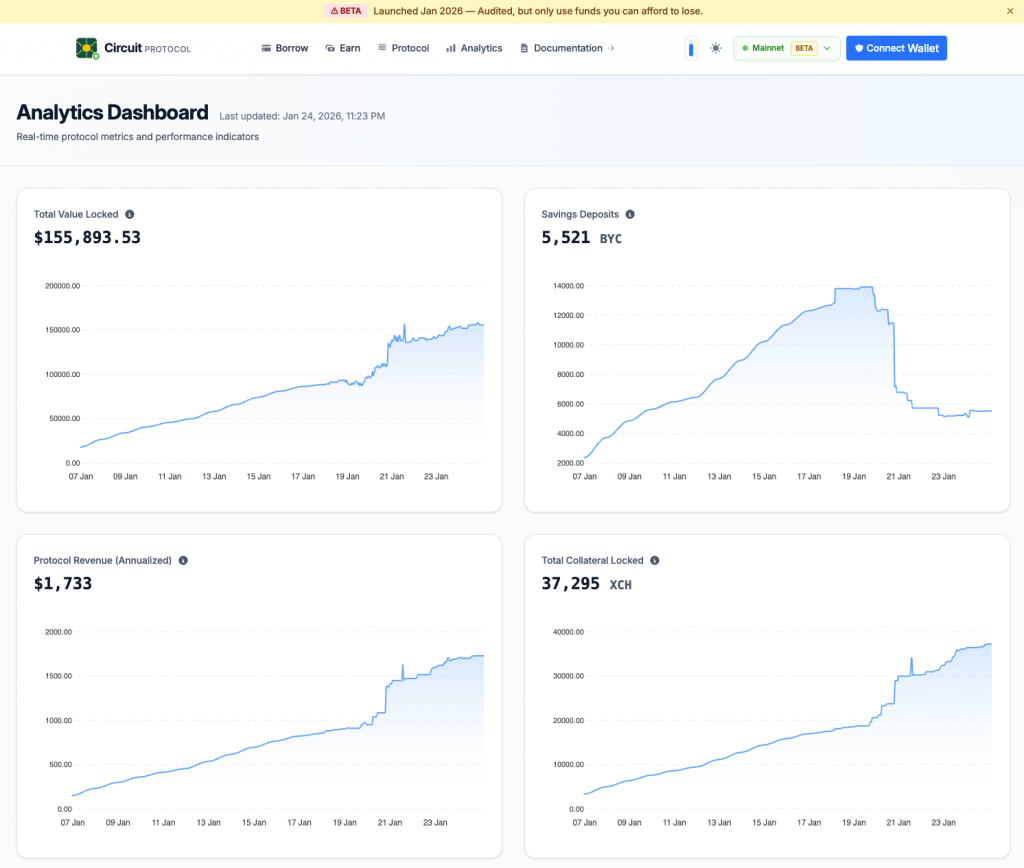

Congratulations on the recent launch of your mainnet beta. The platform already has over 37,000 XCH locked as collateral in just a few weeks. How has this lined up with your expectations? What feedback have you received so far?

It’s good to see that the community has embraced the protocol and more than 0.25% of all XCH in circulation are locked up in Circuit collateral vaults already. We knew there was going to be demand for borrowing against XCH and earning yield on BYC, and what we’ve seen so far matches our expectations.

Feedback has been positive, and we’re particularly grateful for all users that have reached out with suggestions for UI/UX improvements and bug reports.

For the conservative XCH holder who wants to put their XCH to use but is wary of being liquidated, what tools, alerts, or features does the CircuitDAO provide to help them monitor their “health ratio” and keep their loan appropriately collateralized?

The app comes with an account health indicator that shows the borrower the loan-to-value (LTV) of its debt and the max permitted LTV before the vault gets liquidated. In addition, the liquidation price is displayed.

Since the XCH price can be volatile, borrowers should always post plenty of collateral. We have published an analysis of historical XCH drawdowns in the docs that can help borrowers understand the risk.

We also plan to offer a notification service in the future. Until then, users are free to build their own notification tool using the CLI and/or keeper bots as the starting point.

CircuitDAO is unique because governance is handled entirely on-chain. How can one acquire CRT (the governance token) and what specific decisions can they influence?

CRT will be available on the market once the airdrop has happened. We don’t have a concrete date yet, and there’s still time to leave one’s XCH address in the airdrop channel on our Discord.

CRT holders will be able to participate in all governance operations. This means they can submit or veto proposals to change protocol parameters (“Statutes”) or perform certain special operations such as approving an Announcer (a singleton that publishes XCH price data for the Oracle).

Is there a way for community members who aren’t technical to participate in governance? Will there be something like a delegation system for those who want their voice heard but don’t want to manage daily proposals?

There is, via the CLI. Longer-term we are planning to have a governance portal to make participation more intuitive and also as a place for discussion. For smaller CRT holders to participate in governance, they’d need to transfer their tokens to a delegate that votes on their behalf. We encourage community members that want to become delegates to develop inner puzzles for governance coins that allow them to do this.

For those who want to help secure the protocol, how do the “Keeper Bots” work? Is this something a technical community member can run on their home hardware to help with liquidations and protocol upkeep?

Keeper bots are simple Python scripts that perform protocol operations as needed. This includes participating in liquidations, recharge or surplus auctions, transferring Stability Fees to the protocol treasury, etc. The scripts are lightweight and can be run on off-the-shelf PCs and laptops, on SBCs such as the Raspberry Pi, or in the cloud.

Looking ahead, what is the strategy for BYC adoption? Are there plans to work with payment processors or integrate with other dApps like Permuto to make BYC the standard unit of account for the ecosystem?

Better on-/off-ramps is our top priority. We want to get to a point where users can earn yield on the USD in their bank by seamlessly converting it to BYC in a savings vault and vice versa. We’re also looking forward to a lightning-like network based on state channels going live on Chia. BYC would be a great fit for that.

In terms of adoption by dApps, BYC already is the most popular currency for Silicon.net pre-deposits, and we hope to see this repeated elsewhere in the ecosystem. Given that BYC pays interest – as opposed to off-chain collateralized stablecoins like USDC or USDT – there is a good chance that BYC will be used more widely than other stables and become the standard unit of account on Chia.

You mentioned in the recent Chia Community Spotlight that you’re considering a Circuit v2 that handles collateral types beyond XCH. Do you have a timeline on this? Would such a version be able to handle revocable CATs as collateral (such as Permtuo AC/DCs).

Given that there isn’t a confirmed launch date for Permuto certificates or other tokenized RWAs, there isn’t a timeline yet. A v2 would support revocable CATs.

You’ve recently completed major audits (Zellic, Immunefi) and even a public audit competition (Cantina) that saw a lot of participation. For the “regular Joe” putting their hard-earned XCH into a vault, what can you tell them about the security of the smart contracts (Chialisp) and the steps you’ve taken to reduce protocol risk?

We’ve effectively spent all of 2025 on security reviews. It was very important to us to minimize the risk that the puzzles have vulnerabilities. By having three reviews we’ve managed to get hundreds of security researchers to analyse the protocol, ranging from seasoned experts in the field of smart contract auditing to some of the best Chialisp developers in the community.

As an additional safety measure, we have built in a way for governance to freeze some protocol operations in an emergency. In certain attack scenarios this would provide a way to limit further damage and allow users to withdraw their assets from the protocol.

The coinset model of Chia is fundamentally different from the account model of Ethereum. How does CircuitDAO handle high-concurrency events like a mass liquidation during a price crash without running into singleton spend issues?

The protocol uses a custom singleton layer for the Statutes coin. The Statutes singleton contains mutable protocol parameters (“Statutes”), and needs to be spent with almost all protocol operations. The custom puzzle ensures that the byte-representation of its solution is unique, making it identical spend aggregable. This means that the Statues coin spend only needs to be included once per block, instead of having to be included in every spend bundle that performs a protocol operation. This frees up a lot of space, and allows for many more simultaneous protocol operations, such as liquidations, in the same block than would otherwise be possible.

Chia Network Inc. recently announced a 25,000 XCH loan to your team. Can you share details about the purpose of the loan?

Those coins will be deposited in Circuit to mint BYC used to bid in liquidation auctions if necessary. Since the protocol launched fairly recently, there’s potentially only a small number of third parties running keeper bots, so we have deployed our own in order to be a liquidator of last resort. Having said that, we’ve had one non-negligible liquidation so far, in which a third party keeper repaid 1000 BYC of debt and turned a profit of approximately $200 by acquiring collateral below market price. It was nice to see that so soon after launch ecosystem participants are already running keeper bots!

Looking at the next 6–12 months, what are major goals for the CircuitDAO team? What would you consider a sign of success?

We’d certainly like to make it even easier for users to interact with the protocol. This means improved wallet integrations, and better on-/off-ramps for BYC. Also important is liquidity, be it order book depth on Dexie or LP positions on TibetSwap. There’s also a governance portal on the roadmap.

As with any DeFi protocol, a sign of success would be a steady increase in TVL and savings balances.