A few months ago, I shared a recap of all the progress Chia Network Inc. and Permuto Capital were making to bring their single stock voting trusts and issuance of Asset Certificate and Dividend Certificate securities to the market this summer.

Here’s a quick recap before we take a look at their most recent progress:

- January 2025

- Permuto Capital announced in public S-1 filing

- Thomas Chow publishes opinion on CoinDesk’s open letter to President Trump

- February 2025

- Gene Hoffman meets with Donald Trump’s Crypto Council

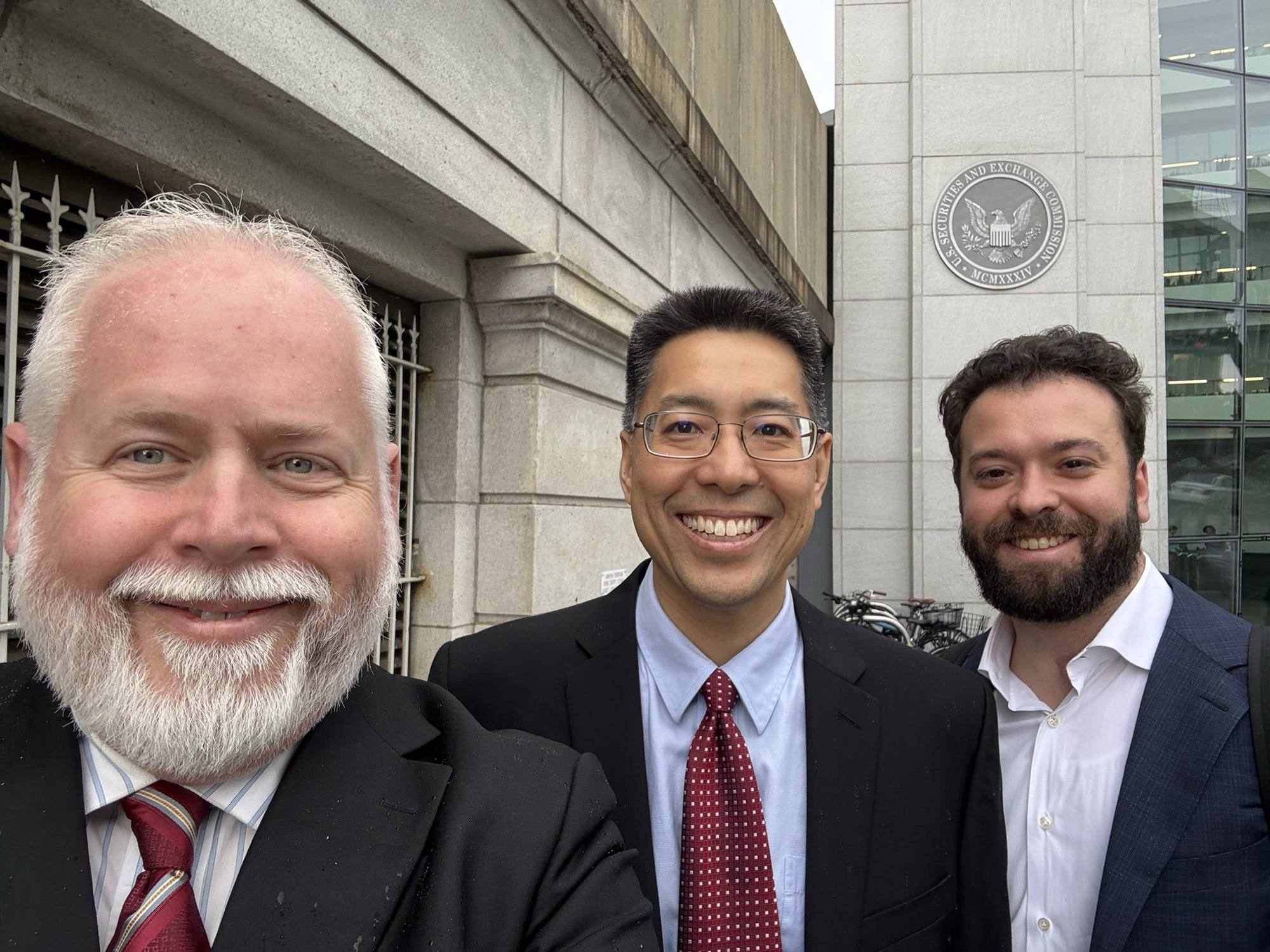

- CNI and Permuto Capital meets with SEC’s Crypto Task Force

- Chia Network’s S-1 documents shared as part of CTF meeting notes

- Digital Chamber welcomes CNI as part of President’s Circle members

- Permuto Capital announces two new trusts (Apple and Broadcom) and S-1 is amended to include U.S. Bank as stock custodian and Fidelity as Transfer Agent.

- March 2025

- Gene Hoffman interviewed by Yahoo! Finance

- Gene Hoffman interviewed by theCUBE + NYSE Wired

- Thomas Chow attends Crypto Task Force roundtable

- Thomas Chow attends Digital Chamber Blockchain Summit

- Thomas Chow publishes comparison of Circle and Chia S-1 documents

- April 2025

- Permuto Capital files S-1 amendment to include PwC as auditor and NYSE American as the national exchange for trading DTC-held certificates.

My expectations at the time was for a few more trusts to be filed, announcement of market maker(s) to provide liqudity on these securities across NYSE American and Chia, and culminating in a launch this summer with 5-10 initial trusts. I also expected the Cloud Wallet to launch on mainnet with support for American Options to serve as a backbone for the Permuto app.

Let’s see what has happened since then. For completeness, I’ll include both minor and major events.

Timeline of Events (continued)

April 9 2025 – Gene Hoffman publishes a blog post on how the Permuto Trusts idea started and how it evolved from a blockchain-only product to one that aims to traded/held on both Chia and DTC/NYSE American to bridge assets between traditional finance and the blockchain.

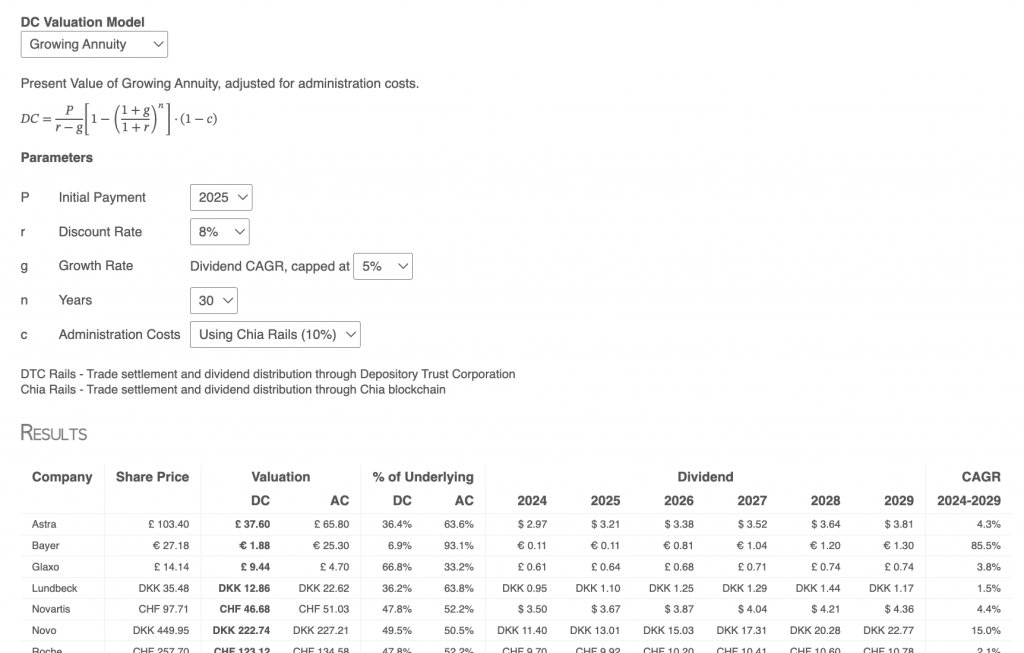

April 25 2025 – Pharmaceuticals equity research provider, DrugAnalyst, publishes two separate DC valuation models and accompanying calculator. I separately wrote about a different valuation model with examples across industries and dividend yield.

May 1, 2025 – Permuto Capital publishes a blog post outlining the product with concrete examples.

May 8, 2025 – Permuto Capital files S-1 amendment for their trusts with the most notable update being the Transfer Agent changed from Fidelity Stock Transfer Solutions to Broadridge Corporate Issuer Solutions. It was shared separately that this change was because Fidelity could not support NYSE American within the desired launch timelines. The Permuto Capital team hosts an X Spaces to discuss the filing.

May 12 2025 – Chia Network COO Vishal Kapoor publishes a short article on the Native Stablecoin Chia Opportunity providing a calculation on how much native stablecoin demand there could be on Chia.

The (Initial) Opportunity for a Native Chia Stablecoin

The first three Permuto single stock trusts – MSFT, AAPL and AVGO – represent a combined market capitalization of over $7 trillion. The serviceable addressable market (SAM) is 5%, based on current regulation, which is about $350B (5% of the combined market cap of those three stocks). At 10% of that SAM on the blockchain that is over $30B in stablecoin.

May 12, 2025 – Gene Hoffman is invited as a speaker on the SEC Crypto Task Force tokenization roundtable on the “The Future of Tokenization” where he shares what Permuto Capital is doing and discusses the distinction between bringing assets on chain and issuing securities natively as tokens.

May 13 2025 – The largest Chia meetup to date takes place in Toronto. In addition to almost a hundred community members, Chia Toronto is attended by CNI and Permuto Capital executives: Bram Cohen, Gene Hoffman, Thomas Chow, Trent Martensen, and Chris McMillan. Gene gives a keynote speaking about expectations of the coming Permuto launch and what it means for Chia Network. Trent caps off the evening with an impromptu AMA answering questions from the audience about future trusts and market opportunities for AC/DCs.

I posted a recap of the Chia Toronto 2025 meetup and a playlist of all the presentations are available on the Chia Network YouTube channel.

May 21, 2025 – Gene sits down Neil Hughes from the Tech Talks Daily podcast to talk about the new Permuto product.

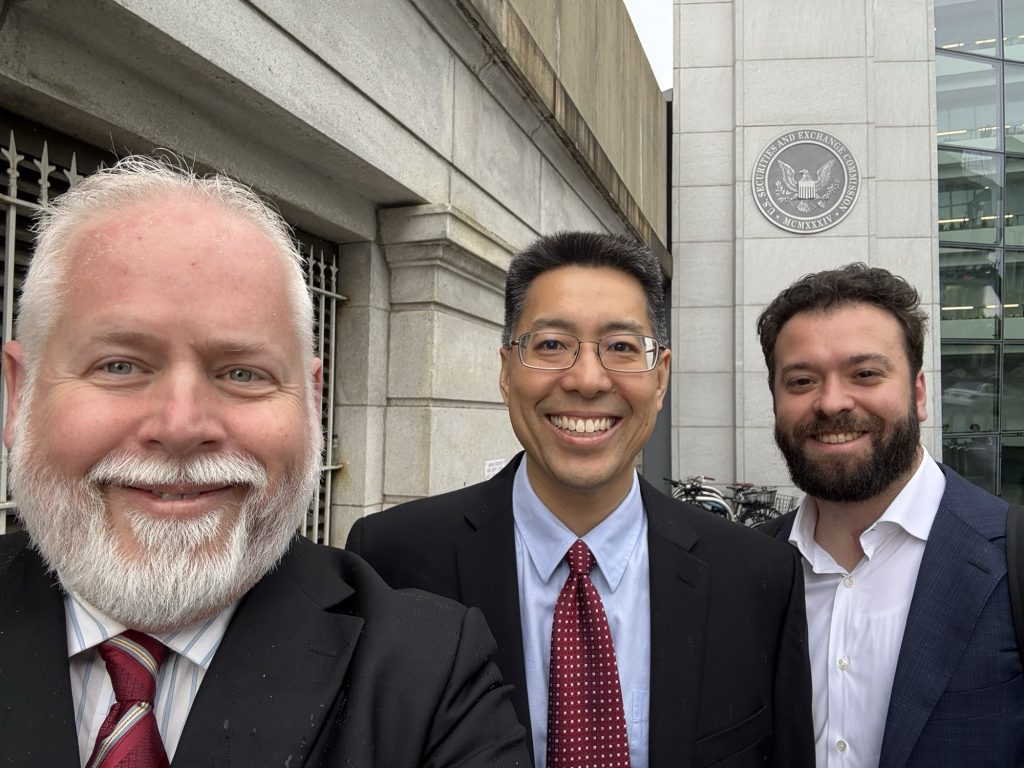

May 27, 2025 – The SEC Crypto Task Force meets again (meeting notes) with representatives of Permuto Capital (Gene Hoffman, Trent Martensen, Thomas Chow) and Skadden, Arps, Slate, Meagher & Flom (P. Michelle Gasaway) on the topic of “Problems with trading securities on most blockchains” such as MEV and centralized smart contracts, contrasting it with how Chia solves/avoids those problems.

June 3, 2025 – Gene publishes a blog post on the same topics as those covered with the SEC Crypto Task Force on May 27.

June 9, 2025 – Thomas Chow provides his play-by-play opinion on the SEC Crypto Task Force roundtable on DeFi.

He ends the thread with this quote:

“@permutocapital is the first new asset class since the ETF and is going through @SECGov public registration. And it’ll be bigger than what we’ve seen in crypto to date.” – Thomas Chow (@chinaesq)

June 11, 2025 – Permuto Capital publishes an article on The Unintended Consequences of Mass Index ETF Adoption and hosted an accompanying spaces to discuss how AC/DCs aim to solve this market inefficiency.

June 24, 2025 – Bloomberg Opinion columnist Matt Levine includes a mention of Permuto Capital in his widely read newsletter with this one titled Everything is an ETF now. Although he incorrectly refers to the Permuto product as an ETF, his conclusion summarizes the product nicely:

“…for absolute completeness you will need to move beyond integer numbers of stocks, and this is the first ETF that I’ve seen that is a fraction of one stock.” – Matt Levine

June 25, 2025 – As predicted in the last post, Cloud Wallet launches on mainnet. This is an important stepping stone to Permuto launch because the Permuto App is built on top of the Cloud Wallet functionality. Gene hosted an AMA to answer questions about the Cloud Wallet launch and future plans.

July 2, 2025 – Permuto Capital files an amendment for their trusts with the most notable change being the addition of details about the Chia blockchain pulled from the Chia Network S-1 and the addition of three notable members to the leadership team. I shared the key takeaways in this tweet:

July 9, 2025 – SEC commissioner Hester Peirce published a statement on the slew of recent tokenized equity announcements and reiterating that the right path forward to reach US investors continues to be the path that Permuto Capital is taking — registering an S-1 for the issuance and sale of new securities.

“As powerful as blockchain technology is, it does not have magical abilities to transform the nature of the underlying asset. Tokenized securities are still securities. Accordingly, market participants must consider—and adhere to—the federal securities laws when transacting in these instruments.” – Hester Peirce, SEC Commissioner

Stay tuned for a deep dive into the different tokenized equity offerings coming to the market and how they compare with Permuto Capital’s AC/DC products.

July 11, 2025 – Thomas Chow’s panel session at DC Blockchain Summit 2025 is available on YouTube where he discusses the role of Layer 1s and the importance of decentralization.

What might we expect next?

From the updates so far, one thing that has been missing are updates about the investment banks and firms that would deposit their equity shares into the trust on day 1. The details of these private conversations may or may not be shared publicly. The entities themselves may not even wish to be disclosed so I would not expect to hear many specifics in this regard. What we have heard is that the discussions are happening and are going well.

At Chia Toronto, it was stated that the hope is to have Permuto AC/DCs start trading before August. Given we can expect at least one more S-1 amendment to fill in some remaining blanks, a July launch seems optimistic.

Over the next month, I am expecting updates such as progress on Permuto app, announcement of market maker partner(s), a couple more trusts, etc. I could then see a launch in August, with significant revenue coming in on day 1 through (perhaps reduced/incentivized) deposit fees. I continue to expect each of the initial trusts to have north of $500M upon launch to ensure sufficient liquidity for trading.

Initially, I also expect the majority of certificates to be held on DTC. Although large institutional buyers and holders of DCs are highly incentivized to custody them on the Chia blockchain, it takes time for these entities to implement new processes and build necessary integrations.

On the Chia side, I am still expecting eventual support for American options in the Cloud Wallet as it is a powerful primitive in traditional mature and liquid markets.