The highly anticipated January announcement was revealed in a press release on Wednesday January 15, 2025 introducing a new equity investment vehicle.

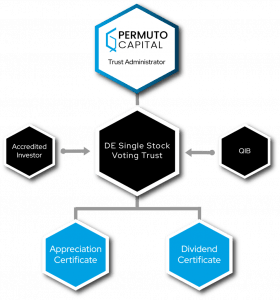

Chia Network Inc. and 3V Capital Partners announced a joint venture called Permuto Capital LLC. Permuto formed a new voting trust investment vehicle called Permuto Capital MSFT Trust I and it has filed an S-1 registration statement with the SEC for a public offering of a brand new financial equity product.

In short, this new product allows shares of Microsoft (MSFT:NASDAQ) stock to be decomposed into two components:

- Dividend Certificate (DC): representing dividend rights of the shares

- Asset Certificate (AC): exposure to underlying capital appreciation

Note: originally ACs were referred to as Appreciation Certificates but was changed to Asset Certificates in a more recent amendment.

By allowing investors to invest in these components separately, this creates new markets built around this new asset class. Investors interested in dividend yield can focus their capital on acquiring DCs, essentially increasing their effective yield. Investors interested in just the underlying value of the asset can acquire ACs at a discounted price from the stock itself.

More trusts formed around other stocks beyond Microsoft are expected in the future.

How does it work?

The voting trust can be thought of a “bridge” converting stock shares into certificates, which can then be tokenized on Chia to be traded.

The short version:

- Deposit: MSFT share gets converted into AC & DC.

- Trade: AC & DC are traded on the market.

- Earn: Dividends get paid to DC holders.

- Exit: AC & DC gets converted back into MSFT share.

The more detailed version:

- An accredited investor (or QIB) deposits MSFT shares into the trust (custodied by US Bank National Association). The trust issues Asset Certificates and Dividend Certificates.

- The investor can choose to hold these certificates as either:

- Certificates held by the DTC: If they want to trade them on traditional stock exchanges (think NASDAQ/NYSE), subject to market hours and halts.

- Chia Asset Tokens (CATs) held on the Chia Blockchain: If they want to trade them 24/7/365 peer-to-peer on decentralized marketplaces.

- Upon dividend payout, Microsoft pays dividends to the trust, and the trust will distribute dividends to DC holders.

- For DCs in DTC, there is a 20% fee

- For DC CATs on Chia, there is a 10% fee and dividends are paid using Secure the Bag

- Accredited investors can redeem pairs of AC and DC back into MSFT shares.

Note that only depositing into and exiting the trust require accredited investor (or QIB) status and are subject to market hours. Buying, trading, selling AC and DCs on the Chia blockchain can be done permissionlessly 24/7/365.

Who is this product for?

There are a few investor types that would be interested in such a product. To help illustrate the benefits of this product, let’s consider this simple example:

- Cost of a MSFT share: $400

- Dividend yield: 0.78%

- Market value of a DC: $40

- Market value of a AC: $360

Investors that only want dividend rights

An investor with $3600 that simply purchases 9 shares of MSFT will earn an annual yield of 0.78%. If the investor only cared about dividends for earning reliable passive income from their investments, they can take their entire $3600 and purchase 90 DCs on the secondary market. This earns them 10x the dividend yield before fees (8-9x after fees).

Pension and wealth funds should be particularly interested in such a dividend product to generate cash flow as part of a diverse portfolio of investments.

Investors that only want exposure to capital appreciation

- Investors that don’t want dividend rights due to income tax complications in their country. They can instead trade for ACs on Chia or the supported stock exchange.

- Non-US investors that don’t have access to western capital markets. They can instead trade for ACs on Chia.

How does shareholder voting work?

Another huge benefit of this structure is that voting rights remain with the certificate holders unlike other financial instruments like ETFs. The exact amount of voting power of a certificate is calculated as a price-weighted average (see S-1 for details).

Why was Microsoft stock chosen for this first trust?

The S-1 filing describes the properties of MSFT that make it desirable for this type of product, namely its long history of steady and low dividend payouts.

“We selected Microsoft Corporation (“Microsoft”) as the Subject Corporation, and its common stock as the Underlying Shares, for our inaugural trust because of its low dividend yield, long history of dividend and operational growth, material passive ownership, and significant dividend and share buyback payout ratios.“

Prospectus Summary, pg 1. S-1 Registration Statement.

Investors that are attracted by the stability of Microsoft’s dividend schedule but desire a higher dividend yield than what is currently offered (0.78% at time of writing) would find this product attractive as a way to get higher effective yield for the same amount of capital (see above).

Is Microsoft a partner in this announcement?

NO! Microsoft is not (and does not) need to be directly involved. It is the shareholders’ choice to deposit their MSFT shares into the trust. Microsoft continues to pay dividends in their traditional manner and the distribution of dividends to DC holders is the responsibility of Permuto Capital.

How will this product scale?

This filing for a MSFT Trust was written to be easily adapted to any other stock with just “search and replace”. The idea is that future filings will be streamlined and much quicker to get through the SEC process, taking days instead of months after this first filing paves a path.

I would expect dozens and even hundreds of stocks to go through the same process and as mentioned above, permission from companies themselves are not needed to create a trust for holding their public equity. On the technical side, scaling issuance of CATs and supporting a large number of trades on the Chia blockchain is a problem to be solved by state channels and L2s.

Is this tokenized stocks?

This is not tokenized stocks. The product itself is decomposing stocks into two certificate components. Those certificates can be issued on DTC or on the Chia blockchain as CATs.

In fact, if you wish to hold a tokenized version of MSFT in this way, it will actually be more expensive to deposit and hold it as a pair of certificates (called a trust unit) than just holding it in a traditional brokerage account.

Since the certificates can exist in non-blockchain and blockchain form, these CATs would be considered tokenized RWAs (for the sake of my 2025 Chia Predictions).

Is this product just for dividend stocks?

Yes and no. Initially I would expect the focus to be on other large market cap dividend-paying stocks but I can see a world where even non-dividend paying stocks get split into AC and DCs. With these stocks, the ACs might maintain the vast majority of the stock value while benefit from being globally accessible and tradable on a blockchain, but the DCs could essentially become a bet on the potential future dividend value of a stock.

It does appear however that the instrument is limited to single stocks though other products could be created by packaging a portfolio of AC/DCs together in the future once enough trusts are established.

When will this product be available?

Today’s announcement was the initial S-1 registration statement. Even without multiple rounds of reviews and amendments, it could take months for the SEC to review and approve. In the meantime, the Permuto team is doing their road show to ensure a highly liquid market with sufficient demand on all fronts to be there during launch.

According to Gene, expectations are to have this product launched in May-July 2025.

How large can we expect this product to grow?

Gene has stated that he expects billions of dollars to be put into the MSFT Trust upon launch. To put this into perspective, the Ontario Teacher’s Pension Plan holds $1.3B worth of MSFT shares (as of December 2023) so it would only take convincing a few similarly large funds to reach that number. Demand for the AC side is less clear to me, but attracting such investors is that the purpose of the road show.

Why would investors choose to hold the certificates on Chia instead of a stock exchange?

Besides getting access to a 24/7/365 market, having CATs on Chia provides access to permissionlessly and safely trade with *any* other asset on the Chia blockchain via P2P Offer Files. This is the concept of One Market.

This market is also open to entire swaths of investors that don’t have access to more traditional exchanges and financial instruments.

Finally, Dividend Certificate holders are charged lower service fees (10% versus 20% for DCs held with DTC) on dividend payments.

Isn’t the 20% fee (10% for CATs) fee on dividend payments high?

As it was explained in spaces (link below), the fee required to cover overhead costs for any similarly created trust to set up the infrastructure and distribute dividend payouts to DCs held with DTC is in the ballpark of 20%. However, there is room on the Chia side to further reduce costs and hence reduce fee while remaining profitable, creating an incentive to tokenize certificates on Chia.

What makes Chia uniquely suitable for digital certificates?

A common question has been “Why can’t another blockchain copy this idea?”. The answer is a combination of reasons:

- Advanced custody: Chia’s focus on developing enterprise grade custody solutions like Cloud Wallet + Vaults + Chia Signer are critical requirements for institutions to custody billions of dollars comfortably. These solutions go beyond just multisig and hardware wallets like what other chains offer. The ability to set up slow wallets and clawbacks answer questions like “What if one of the executives leave the company or lose their keys?” or “What happens if a hacker gains access to the majority of our keys?”

- Coinset model: A coinset model provides true ownership of an asset (in contrast to the account model) that has important legal considerations, especially when combined with Offer files.

- Offer files: The peer-to-peer nature of trading assets using Offer files allows for permissionless trading and unique advantages such as the ability to provide liquidity or list DCs to sale while maintaining ownership and hence dividend rights until the DC is actually sold.

- Secure the Bag: The ability to cheaply and efficiently send millions of transactions is critical for handling dividend payments to DC holders (Read more).

No other chain has all of these features. This makes Chia uniquely suited for institutions to self custody digital certificates.

Why hasn’t anyone done this before?

The idea of splitting off the dividend component of a stock isn’t new, but it is not widely available and expensive to operate. The insight of using single stock voting trusts that are exempt from the ’40 Act to issue these certificates is novel and coupled with the efficiencies of using the Chia blockchain to manifest the necessary operational savings means this is the first time a viable solution is available and creates a new asset class for trading.

Who is 3V Capital Partners?

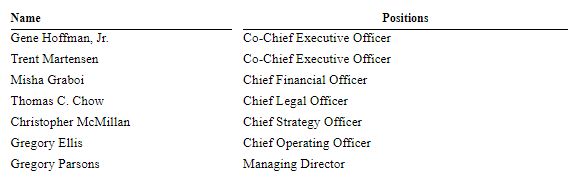

Permuto Capital is a joint-venture between Chia Network Inc. and 3V Capital Partners. The co-CEOs are the respective CEOs of both companies, Gene Hoffman and Trent Martensen. Other key personnel include Misha Graboi (CFO) and Thomas Chow (CLO) from Chia Network Inc. and Christopher McMillian from CAVU Securities.

Trent and Christopher are both former Credit Suisse bankers that had worked with Chia Network Inc. on their IPO filing back in January 2023 prior to the collapse of Credit Suisse. This venture started from an idea that Trent had and was made possible by an insight from Gene on how to leverage a blockchain to offer the product in a cost effective manner.

How does this benefit Chia Network Inc?

CNI is a 50/50 joint-venture partner and hence could receive up to half of the profits generated by Permuto Capital through deposit/redemption fees, and services fees on dividend payouts — depending on how the structure is set up. This creates above-the-line revenue for CNI and could mean that prefarm sales may no longer be needed to fund operating expenses.

How much revenue? On just deposit fees alone, if we see $5B of MSFT shares deposited, that translates to $12.5M of revenue for CNI on top of ongoing services fees from dividend distributions.

This significant revenue stream also strengthens CNI’s value proposition, and if the product is successfully launched, it creates a clear path towards an IPO this year.

This product also fills blocks. Secure the Bag dividend payments along with any secondary market trading activity will take up significant block space, creating a fee market and ultimately increasing the fundamental value of XCH.

So what’s next?

We should be hearing more announcements in the coming months about how Permuto plans on getting these certificates listed on a traditional exchange, as well as names of institutions that are committed to deposit their shares into the trust and/or create demand for the certificates.

The biggest open question in my mind is exactly how they plan to bring together all the necessary parties to make it work. It feels like a chicken and egg problem since there needs to be sufficient supply of MSFT shares to go into the trust, sufficient demand on both the DC and AC side, and massive liquidity (billions) for the value of this financial instrument to be truly realized.

More Information

If you want to learn more, FoMO did a great overview of the announcement:

Permuto Capital co-CEOs Gene Hoffman and Trent Martensen answered many questions on Spaces:

There will also be an AMA on Friday January 17, 2025.

Here are other threads that summarize the announcement:

2025-01-20 update: Clarified definitively that Microsoft is not a partner in this trust, and updated the language about potential revenue sharing with CNI.

2025-08-28 update: Renamed “Appreciation Certificate” to “Asset Certificate” to reflect the most recent filings.

great work slow! Let’s use the comments section too. How is the traffic on the website today?