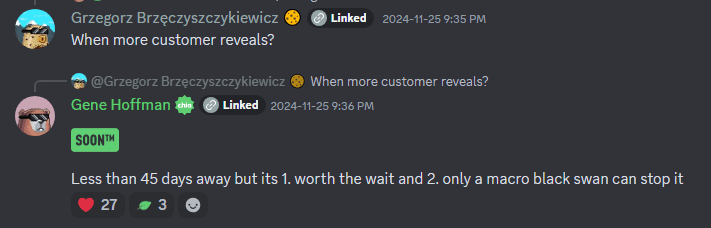

In the last few weeks, the Chia community has been abuzz with excitement and anticipation over a big upcoming announcement in January from Chia Network Inc. as publicly teased by Gene in Chia Discord and the global town square that is Twitter/X.

Coming off the 12 Days of Chia Bullishness, I was already excited about the future of the Chia ecosystem but this next announcement might take Chia to a whole other level.

More details were revealed across a slew of public Twitter Spaces and interviews over the subsequent past weeks. Here’s a non-exhaustive list of them:

- #Chia $XCH Gene Hoffman #ArtThursdays hosted by @ArtwithHeartNFT

- @MatthewSHintz

- One Market, take 2 hosted by @hoffmang

- +C.O.C ft Chia Network CEO Gene Hoffman & TangTalk hosted by @thyrevolution

- What about Bob? hosted by @hoffmang

There’s lots of interesting discussion that makes these Spaces worth a listen end-to-end but I also understand it’s tough sitting through hours of them, so I’ll summarize what we know so far based on what has been shared. Do your own research and come to your own conclusions and don’t take any of this as financial advice.

What has been said about the announcement

- CNI will be sharing details about a “new financial product” some time in January.

- It falls into the “Real World Assets” category and utilizes CATs.

- The exact date of the announcement is unlikely to be too close to the US Presidential Inauguration (January 20, 2025).

- The exact date may be delayed by a week or two depending on whether “service providers” will be ready.

- Unlike typical partnership announcements, this one is almost entirely within CNI’s control so an announcement will be happening short of a macro black swan event (e.g. war, big economic recession, etc.)

- The product launch and any impact to the blockchain is not expected to happen right away alongside the announcement, but instead over the following 6 to 9 months.

- The details of announcement has already been shared internally to the Chia Network Inc. team in early December as the team will be focused on delivering this product over the next month.

- There will be AMAs, interviews, and Twitter Spaces after the announcement to dive deeper and answer questions.

My thoughts: given the nature of software development and working with third parties, I would not be surprised to see the announcement come in late January or early February (despite the 45 day expectation mentioned on Discord).

What has been said about the product

- It will be a “groundbreaking financial product” that wall street wants. This includes hedge funds, family offices, pension funds, etc.

- A typical response from these companies is initially disbelief, followed by enthusiasm.

- It is a product that is only possible with a public blockchain, and Chia is particularly suited to enable it with its technology (coinset, Offer files, One Market, Secure the Bag etc.)

- The product is able to provide higher yield than traditional financial instruments, partly through efficiency of removing the need for middlemen.

- The scale of this product makes the World Bank CAD Trust project pale in comparison (“a campfire vs a forest fire”).

- It will bring millions of dollars of value onto the Chia blockchain pretty quickly, and eventually billions and trillions. It could eventually drive quadrillions in annual on-chain volume.

My thoughts: seeing the word “quadrillion” might be shocking but keep in mind the DTCC processed $3 quadrillion USD in securities transactions in 2023. Also it’s worth clarifying that “millions of dollars of value onto the Chia blockchain” doesn’t necessarily mean all that value will flow into XCH.

What has been said about its impact to Chia

- It will eventually fill blocks (in 18-24 months) and create sustained fee pressure.

- It will eventually require an L2 to scale, hence the push for Bram to build chia-gaming to prove out the concept of state channels.

- It will create a large ongoing revenue stream for Chia Network Inc., which will be important as they aim towards a public offering.

- Prefarm sales are expected to slow down and eventually stop in 2025.

- CNI is actively hiring and is expected to double/triple their team to continue expanding this product throughout 2025 and beyond.

My thoughts: all of the impacts are undoubtedly positive for both Chia. The desire for any L1 is to fill blocks and generate fee pressure since that is critical for a chain’s long term security. Retail users may balk at high L1 fees but L2s should alleviate that concern — assuming they are ready in time.

What I think the product is

Currently nobody outside of CNI’s internal team and their partners know exactly what this product is, but based on what has been shared, I do have a guess.

I think it’s a new “primitive for finance” that can be a building block to rebuild traditional financial instruments in a new and more efficient way. I share a bit of context around where part of where extra yield might come from in this tweet:

As for the specifics, I’ve committed my guess about the core idea in a sha256 hash to be revealed after the announcement to see if my guess was correct:

Along with further details about how it might play out:

Time will tell whether my guess is correct and whether these very ambitious plans will play out the way Gene and CNI expects but it will undoubtedly be an exciting next few months!