What is the halving?

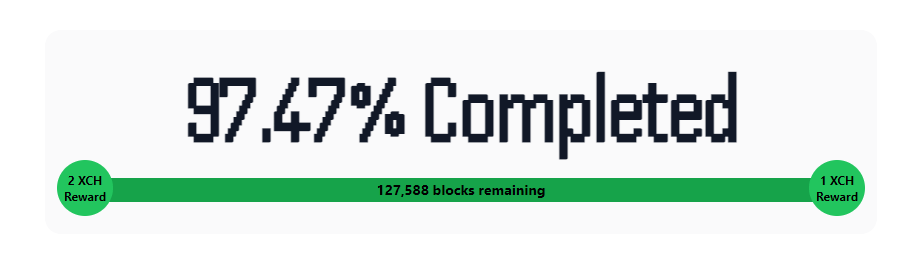

Chia has an emissions schedule that is similar to Bitcoin, where block subsidy rewards are cut in half every few years. Four weeks from now (around March 7, 2024) at block height 5045760 each block reward will be cut from 2 XCH to 1 XCH, marking the largest drop in supply inflation rate that the chain will have.

| Halving | Month (Est.) | Block Reward |

|---|---|---|

| 2 XCH | ||

| 1st | March 2024 | 1 XCH |

| 2nd | March 2027 | 0.5 XCH |

| 3rd | March 2030 | 0.25 XCH |

| 4th (Final) | March 2033 | 0.125 XCH |

Unlike Bitcoin however, there are only four scheduled halvings every ~3 years at which point trailing emissions of 0.125 XCH block rewards will ensure a continued security budget regardless of transaction fee subsidy while the inflation rate asymptotically approaches zero relative to circulating supply.

When is the halving?

Based on the standard daily current block production rate, the first halving is estimated to be around March 7-8, 2024. You can follow a countdown to the exact block height at a couple of sites:

What will happen to XCH price?

Nobody can predict with certainty what will happen with the price of XCH but there here are some potential justifications for different scenarios. The following is my personal opinion and not financial advice.

Why might XCH go up in price?

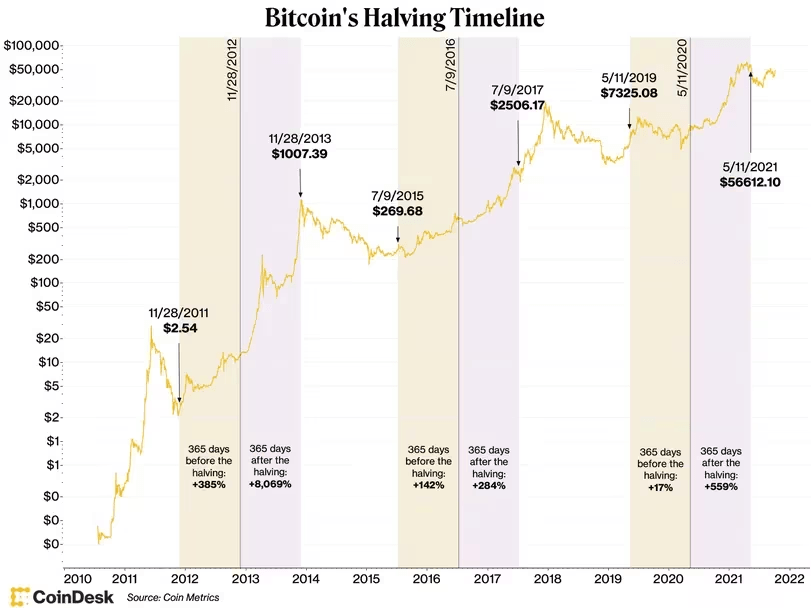

- Bitcoin halvings have historically been followed by sharp increases in price.

- Simple supply and demand economics suggests decreased supply paired with unchanged demand results in higher price.

- Chia’s halving coincides closely with Bitcoin’s halving in April 2024. An increase in Bitcoin price generally leads increases across the whole crypto market.

- Macroeconomic conditions point to a potential bull market in 2024.

- Chia continues to announce high profile partners such as the World Bank and drives up XCH demand.

Why might XCH stay the same price?

- “Everything is priced in”. The efficient market hypothesis would suggest that this planned halving is already priced into the existing price and hence no change should be expected.

- Real XCH trade volumes are relatively low, many farmed XCH are not being sold nor is there enough demand to move markets in either direction.

- Price pressure in both directions cancel out.

Why might XCH go down in price?

- Halvings in some other chains have resulted in sustained lower price.

- Some farmers with high operating expenses may find themselves unprofitable at halved block rewards and decide to shut off or even liquidate their assets.

- Macroeconomic conditions remain uncertain and will hurt riskier asset classes such as crypto.

- The sale of XCH from the prefarm via a market maker puts downward pressure on price.

What will happen to netspace?

I think this widely depends on price (or maybe price depends on netspace?). If XCH price decreases or even remains the same, farming revenue will be cut in half, resulting in some farmers shutting off their farms — especially those that have higher opex costs. This would result in netspace finding equilibrium with coin price at a lower point than it is now.

Similarly, a higher price may draw in new farmers or encourage existing farmers to expand with new raw space or pursue a higher compression ratio. I predict netspace to remain relatively unchanged due to the stickiness of Chia farming that we’ve observed in the past as many low opex farmers can continue to farm at reduced profitability.

Wisdom of the Crowds

I put up a poll on X to see what the community thinks will happen to XCH price after the first halving. Interestingly the results are pretty evenly split:

And some more specific predictions:

Time will tell! What do you think will happen?

[…] storage and elapsed time began almost a decade ago in Bitcoin developer IRC channels. As we past Chia’s first reward halving marking almost 3 years since mainnet launch, let’s take trip into the past to the beginnings […]

[…] @SlowestTimelord announces XCH.farm has been updated to reflect 1 $XCH rewards after halving. Read more about the halving on XCH.today • Source […]