In January 2025, a new joint-venture called Permuto Capital LLC between Chia Network Inc. and 3V Capital Partners was announced along with a S-1 registration statement for Permuto Capital MSFT Trust I. This introduced a novel financial instrument to allow Microsoft stock equity to have its dividend rights split into a separate component.

(See a previous article Permuto Capital and a New Financial Product Explained for an in-depth explanation of the product.)

Today, Permuto Capital announced that they have filed an amendment to the Microsoft (MSFT) trust in response to the first round of SEC comments along with new filings for two new trusts for Apple (AAPL) and Broadcom (AVGO) stock.

Links to filings on EDGAR:

Tip: To stay on top of newly filed trusts from Permuto Capital, you can bookmark this EDGAR search query.

Notable Amendments for MSFT Trust Filing

The amendments to the MSFT filing should be directly addressing the SEC’s first comment letter (which will turn public 20 days after a “no further comment” letter is issued at the end of the review process). Looking at what amendments were changed can give us a glimpse into what questions or concerns the SEC had in their first comment letter.

Here are the notable amendments I found in comparing the initial and amended filing for Permuto Capital MSFT Trust I.

Appreciation Certificates renamed to Asset Certificates

This is a change I really like. The term “appreciation certificate” can have misleading implications as the underlying asset minus dividends will appreciate and depreciate in line with the asset value. I had thought a better term could be “Capital Certificate” but “Asset Certificate” is equally appropriate while maintaining the AC/DC connection.

Minimum Deposit Share Amount

This was changed from specifying a number of shares (500 MSFT) to a dollar amount ($25,000), and is consistent across AAPL, AVGO, and MSFT filings. This makes sense as fees are calculated on the dollar amount, while further genericizing the filing to ease future trust registrations.

Services Fee renamed to Dividend Fee

This is another change in language that makes a lot of sense to me. The fee taken on dividend payment (10% for certificates held on Chia, 20% for certificates held on DTC or otherwise) was originally referred to as “Services Fee”. This makes a lot more sense being referred to as the “Dividend Fee” since it alleviates confusion with the “Deposit Fee” and “Redemption Fee” that are taken upon shares entering and exiting the trust respectively.

It is also clarified that the Dividend Fee is the only ordinary recurring expense, though market makers could be triggering recurring deposit and redemption fees as well, though at a less predictable schedule.

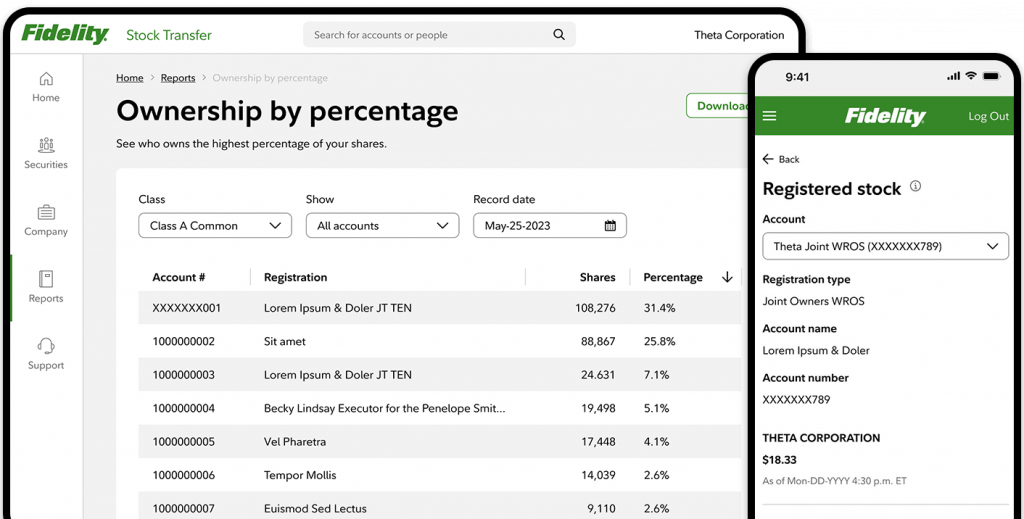

Fidelity named as Transfer Agent

In the initial filing we read that U.S. Bank was engaged as the custodian of deposited MSFT shares, but the Transfer Agent was not named. In the amended filing, Fidelity Stock Transfer (launched by Fidelity Investments) was named as the certificate registrar and transfer agent.

Fidelity Stock Transfer is a digital-first stock transfer agent solution announced on January 13, 2025 — interestingly just 2 days before the initial Permuto Capital trust filing.

This means Fidelity will be a bridge for certificates between Chia and DTC, and Fidelity’s new digital product offering could mean a very seamless and fast user experience to move certificates between the blockchain and traditional stock exchanges. I’m sure reduced friction will be welcomed by market makers across both ecosystems.

Trust holding limit reduced from 10% to 5%

I assume this is to limit complications of Permuto holding control of too large a voting share. 5% of MSFT market cap is still massive and unlikely to be hit soon in my opinion.

No more accredited investor requirement to be a depositor

This was surprising to me as I would not expect the amended filing to be *less* restrictive but this actually opens up accessibility to investors as long as they meet the $25,000 minimum threshold to deposit shares into the trust.

Updated Risk Factors

One notable risk factor was added to the list of risk factors covered in the filing: Holders of Asset Certificates and Dividend Certificates, respectively, may have actual or potential conflicts of interest. In theory the pricing of AC and DC are inversely correlated so there’s a very good risk called out in how these groups can be in conflict with one another in the market with respect to pricing. A number of other risk factors were also consolidated together.

Take-away

Overall it seems like the SEC had very few comments and mostly relate to clarification of language. In particular, “Asset Certificate” and “Dividend Fee” are very good improvements in wording choice to me.

What comes next?

It would appear that the Permuto team was comfortable that the SEC comments were light enough that they were confident in filing two more trusts (AAPL and AVGO) with the same updated language as the amended MSFT trust filing. Approval of the S-1 appears likely to me in the next couple months.

In the meantime, I think we can expect more S-1 filings leading up to the official “launch” of the first Permuto trust. Gene has alluded to eventually getting up to 80+ trusts in the long term. I would expect a dozen or so trusts across various industries for the team to take to an initial roadshow in attracting investors.

Now that the custodian (U.S. Bank) and transfer agent (Fidelity) have been announced, I would also expect more confirmations of remaining service providers needed to connect all the blockchain and traditional finance plumbing together for this new financial instrument. For example, the role of DTC may be clarified further.

There should be a steady stream of news trickling out until the launch. I am expecting an announcement about the national exchange the certificates will be listed on. We may even hear about rating agencies, market makers, broker-dealers, auditors, and initial investors (depositors) in the coming months.

Further Discussion

For further reading and discussion, Forbes has a contributed article about the latest round of filings: Blockchain-Powered Certificates Redefine Stock Ownership

The Permuto team hosted a Twitter/X spaces discussing the announcement and their recent meeting with the Crypto Task Force: