Peer-to-Peer is a series of Q&A style interviews with members of the Chia community. This interview is with madMAx, notable creator of the madMAx Chia plotter and Gigahorse compressed plots, which makes up almost a third of the Chia netspace today.

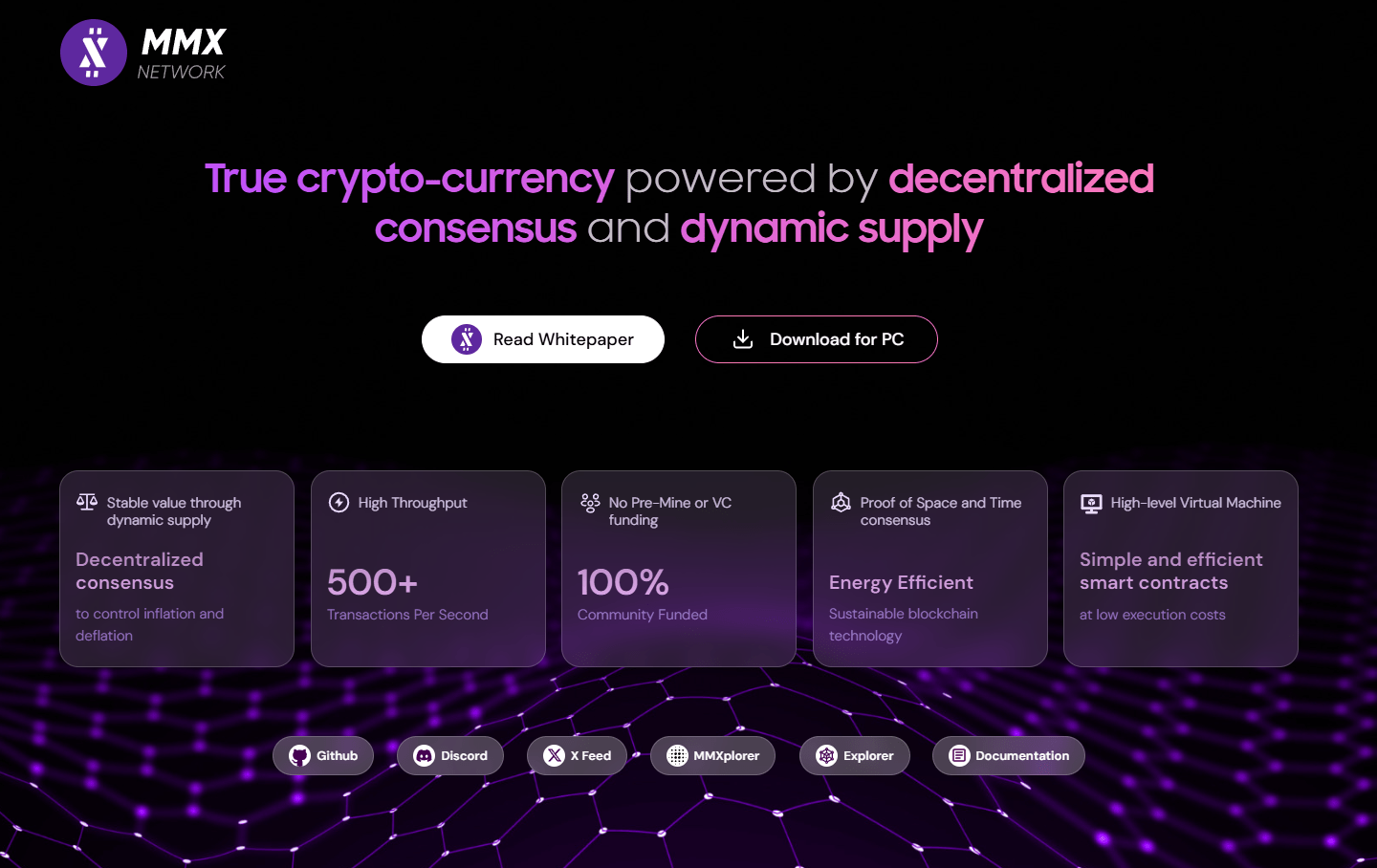

He recently launched a new blockchain, MMX Network, based on a similar Proof of Space and Time consensus as Chia but with some very meaningful differences. The MMX token is meant to be used as a currency, with value stabilized through a combination of dynamic supply and fee burn.

- Twitter: @MMX_Network_

- Website: https://mmx.network/

- Explorer: https://mmxplorer.com/

Editor’s Note: This interview was not sponsored and should not be taken as endorsement of any particular product or company.

Hi, thank you for answering some questions for our readers about you and your new blockchain, MMX Network.

Can you tell us about your background and your journey with developing Chia plotting software and compression?

It all began around Christmas time 2013, when I developed a GPU miner for the CPU-only Primecoin (XPM), eventually building out a mining farm of 72x 280X GPUs. That was working great initially but didn’t last long, it’s now open source (madPrimeMiner). I came back to crypto during the 2021 bull run when I randomly discovered Chia.

Like many people, I panic-bought lots of HDDs not knowing it would take forever to plot them. So while I was slowly plotting I was looking into the code and trying to see if it can be improved. The code was very complicated and almost unreadable as it was written by a mathematician. So naturally I decided to just start from scratch as always, working on weekends and after work as a hobby. I never thought about making money from it, nor did I think it would create such a following.

Needless to say, people were very happy to use it. A few weeks later I was contacted by a whale group looking to plot faster with GPUs and planning to farm in the cloud too. So I developed a multi-GPU plotter for them using 16x A100 to do it all in VRAM. It pumped out plots faster than the 100G network could handle. They didn’t tell me they planned to use archive storage on GCP (Google Cloud Platform) to farm these k32 plots. They assumed one lookup would be one access, but in reality it was more than 10 (1 seek = 1 access). So k32 wouldn’t be profitable to farm in the cloud due to the high IOPS. Then I realized using a higher k size would reduce the IO a lot. So I developed a k37 GPU + RAM plotter for them, using 10x Dell R730 with 1 TB RAM and two A4000 each, connected via dual 100G Infiniband. Once that was done the price of XCH fell so much that farming in the cloud, even with k37, was no longer in the picture. So all the work was for nothing.

“Eventually NoSSD came around and I began looking into compression for the first time. It didn’t take long to figure it out and implement a GPU plotter + farmer. The problem was how to monetize it.”

Eventually NoSSD came around and I began looking into compression for the first time. It didn’t take long to figure it out and implement a GPU plotter + farmer. The problem was how to monetize it. Initially I didn’t want to create a closed source Chia farmer, due to the complex nature of Chia’s code base and their use of Python. So we tried to sell the code to Chia Network instead. After months of negotiations that didn’t pan out, so I had to look into making a closed source farmer after all. It was quite a pain to work with Python but eventually I was able to pull it off. Did you know the idea for Gigahorse 3.0 came to me the day our daughter was born? Luckily we had our mother-in-law to help take care of our newborn, so I could work 24/7 on that for many weeks.

So then what made you decide to start a new blockchain project?

I started working on MMX when the thing happened where I had to work from home, and I got bored with the day job. It only took me a week to quit and work on MMX full time (apart from Gigahorse). It’s always been a passion project, not necessarily a business. But that’s the same way Bitcoin was created. I started MMX because I liked the new idea of Proof of Space and Time, but I didn’t like Python or LISP, not one bit. At first I planned for it to be a simple UTXO blockchain like Bitcoin, but over time it evolved into much more than that.

As you may expect, MMX will naturally draw comparisons to Chia. I’m curious about some unique technological choices you made.

You mention it started as a UTXO blockchain, similar to Chia’s coinset model, why did you evolve it to an account model?

Initially MMX was UTXO based, but as I developed more features into it, many problems arose from it. Once I started working on smart contracts I finally saw the light and switched to the account model. There really aren’t any drawbacks to it, only benefits. At least when you implement it the way I did in MMX, with random nonces and not sequential ones like in EVM. You can create a new address for each receive to get the same pseudo-privacy as with UTXO if you want to.

Why do timelords in MMX earn rewards?

Timelord rewards is something that shaped MMX quite a bit, it took many iterations to finally make it work without any flaws or loopholes. Security is defined through the product of space and time, so it’s only natural to reward the time component as well. I think Chia doesn’t do it because it’s really difficult to do so, it requires fundamental changes to the proofs of space as well.

As a funding model, why did you decide on funding through transaction fees (network activity) instead of a prefarm/premine?

I never liked the idea of a pre-farm as it would undermine the utility as a currency, so that was never planned from day one. After some time I realized the ideal way to reward development is through actual usage of the chain, not by minting new coins. It’s simply the most honest way. Just to be clear, the “dev fee” is a percentage of transaction fees. Not a percentage of funds being transferred, as with credit cards, which is a scam if you ask me.

Why did you choose a Javascript based VM instead of something like Chialisp?

Chialisp was a no-go for me right away, it’s something a mathematician would like. To me it’s like trying to read Chinese. But I also didn’t like all the other approaches, since they were built on low level VMs where you deal with bits and bytes. That just never made sense to me when your goal is high level smart contract logic. Low level is for hardware, not for software. So I started with how I wanted the language to look like: It should be simple, no fancy syntax or endless features, like with Rust or C++. Naturally that led me to a C like language without strong typing: JavaScript.

Smart contracts should never be more than 1000 lines or span across multiple files, such monsters would be impossible to understand and verify. Hence you don’t need any advanced language features, like OOP, macros or templates. Because the VM is high level you don’t even need a standard library. As a bonus the compiler is also dead simple to implement. Performance is better too, since the number of instructions is much smaller. The bottleneck is not CPU anymore, it’s random reads to the database.

One of the most interesting aspects of MMX is its dynamic supply as a mechanism to peg the value of MMX to gold (2000 MMX per 1 troy ounce of gold). From my understanding, this will effectively create a ceiling on the value of MMX while the floor is maintained through fee burn once the network is actively used. Can you discuss how you intend to spur network activity?

As I didn’t want MMX to be a VC (venture capital) coin, where it just devolves into a hype project to enrich VCs, with me being their work slave, there is a chicken and egg problem to adoption. It took Bitcoin many years to move from a joke to being something. So I see MMX being on a similar path, it will take time. It’s not a hype coin with millions being spent on marketing. Nor is it a fixed supply ponzi / meme coin.

There’s two components to adoption: awareness and utility. We need to build out both over time. MMX can be used to replace credit cards for online payments. That is the intended use case. Personally I always find myself in a conflict of where to keep my savings. Banks can seize or gamble away your balance at any time, fiat can hyper-inflate, stable coins might be a scam and no longer backed when I need it. On the other hand fixed supply tokens are a pure gamble to hold, it’s all based on hype. So you end up having to choose between trusting and hoping. I don’t like either of these. This is where MMX comes in, it’s not a gamble to hold MMX and there’s no trust required. You can spend it without worrying what it might be worth the next day. That’s what you need for a currency, you have to abandon the “hope it’s worth more tomorrow” scheme.

“…you end up having to choose between trusting and hoping. I don’t like either of these. This is where MMX comes in, it’s not a gamble to hold MMX and there’s no trust required. You can spend it without worrying what it might be worth the next day. That’s what you need for a currency, you have to abandon the “hope it’s worth more tomorrow” scheme.“

So the plan is to get integrated with existing crypto payment service providers and maybe some vendors who will accept it directly. At the same time we need to wait for the crypto community to finally get tired of gambling. While trying to tap into a new market where anti-crypto sentiment can be turned into MMX, since it’s fundamentally different. It’s not a hype coin, it’s not wasting energy, it’s not quasi-centralized and it’s not crippled by its own limitations.

I see you launched out-the-gate with a ton of features including an AMM, swaps (offers), and token and NFT standards. Do you see these features as a core part of the future MMX ecosystem or are they supplementary to MMX’s main use case as a currency?

They are a core part of course. For example, stablecoins are still useful as an on/off ramp. I’m working on a browser game that will use a token on MMX for its currency, as well as NFTs for in-game items, so players are in control of their assets. Tokens in MMX are quite different than, for example ERC-20, they are native assets and not a variable in a smart contract. Owning tokens is the same as owning MMX, they are in your wallet, no shady contract code can steal them. The same goes for NFTs on MMX. Have you ever used an EVM blockchain? Where you need to sign 5 transactions to deposit liquidity to an AMM? No such hassle with MMX, a single TX is enough, no approvals needed.

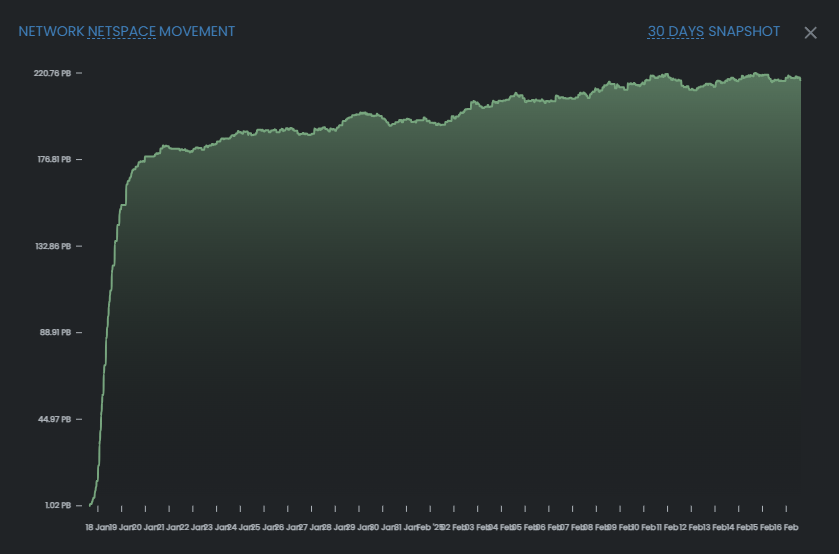

At the time of writing, the netspace is around 220PB which translates to a security budget of $5-10M according to the whitepaper. Did this live up to your expectations? Do you envision MMX to get up to the 10-20 EiB range of netspace?

We saw the growth of testnets from 10 to 150 PB before mainnet, so 220 PB is well within what was expected from that. At the beginning I was aiming to have 100 PB at mainnet launch, and many said it’s going to be more than that. The minimum reward was designed to sustain exactly that. But we also saw Gold go from $2000 an ounce to now $2900, so the target price of MMX has increased by almost 50% since the start of development. For netspace to go much further, adoption is required to increase demand for new coins above the minimum reward level, and then sustain it through transaction fees. 10 to 20 EB will require around 100 standard transfers per second on average.

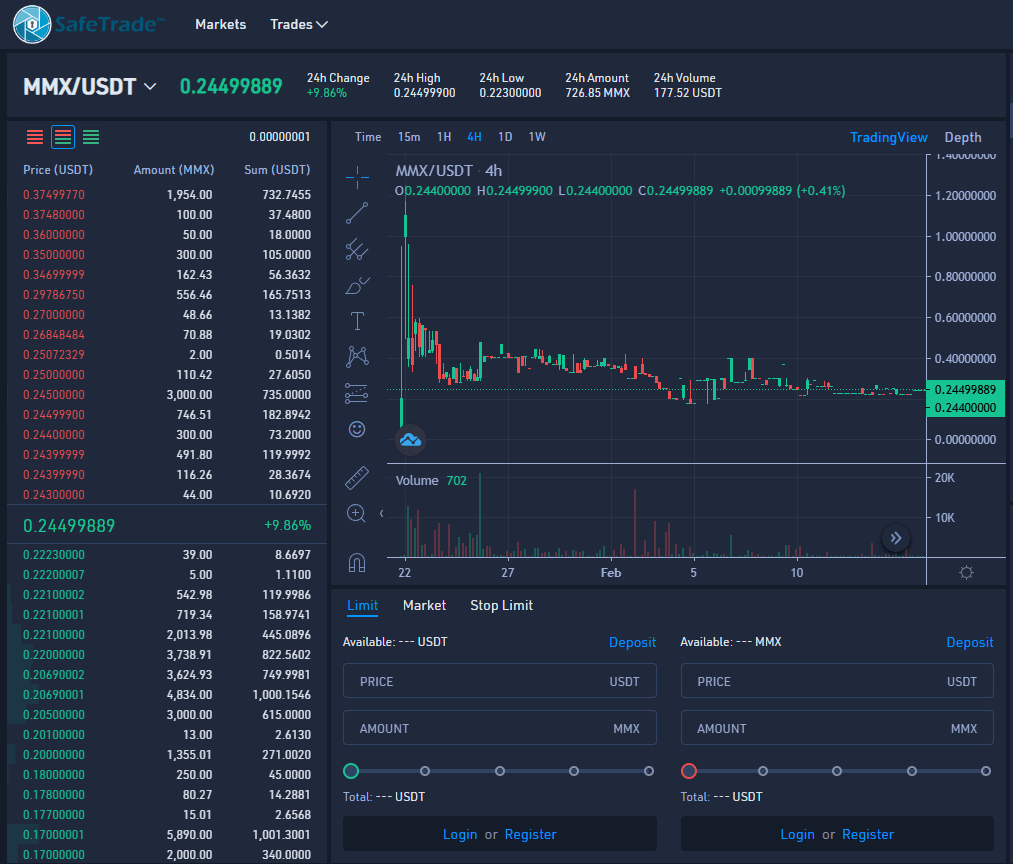

It was nice to see MMX proactively get listed on a CEX (SafeTrade). Can we expect further CEX listings in the future?

We are working on getting listed on a bigger exchange, such as TradeOgre. It has to be one that won’t cost more than $5k to get listed. I’ve heard other exchanges do list for free, but you need like 100,000 X followers or more, so they can be sure there will be enough volume.

We might also develop a bridge like warp.green, so you can trade directly on-chain against wrapped USDC.

Thank you for taking the time to chat, is there anything else you would like to share with XCH.today readers?

The website for MMX is finally live, so we can start spreading the word. It’s at https://mmx.network/ where you can find all relevant links, like the whitepaper, downloads and block explorer. Also give us a follow @MMX_Network_, thank you.