This article was adapted with permission from a Twitter article by @XY_03012009. See the original article for further discussions.

Imagine you could take a single share of Microsoft and split it right down the middle—one half dedicated purely to dividend payouts, the other capturing all the future price gains. Sound revolutionary? That’s exactly the new frontier Permuto Capital is exploring, using the Chia blockchain to reshape the way we own and trade big-name stocks. If you’ve ever wondered what true innovation in traditional finance looks like, this might be it.

Before we start: Credits to @FomoTheShow & @grantosan ⏩ Please follow and leave some love. This article is a summary of their interview with Gene Hoffman CNI CEO. You can find this interview here:

Now let us start with the future of the Financial Industry.

Table of Contents

- Introduction: A New Dawn for Stock Trading

- What Is Permuto Capital?

- Splitting the Stock: Dividends vs. Appreciation

- Why Microsoft? The First Trust Explained

- Inside the Trust: Fees, Mechanics, and the Role of US Bank

- Regulatory Path: The S-1 Filing and SEC Outlook

- How the Chia Blockchain Fits In

- From dtcc to Blockchain: Bridging Traditional Markets

- Market Makers, Offers, and the Magic of Peer-to-Peer

- Global Implications: Beyond the US Market

- Voting Power and Corporate Governance

- Long-Term Vision: Future Trusts and Expansion

- Why This Matters: Key Takeaways

- Conclusion: The Road Ahead

1. Introduction: A New Dawn for Stock Trading

The global equity market is massive—consisting of millions of trades daily, regulated pipelines, custodians, clearinghouses, and a multitude of brokerage firms. Over decades, these intermediaries have shaped an extremely efficient yet sprawling infrastructure designed to handle the complexities of modern finance.

Despite these efficiencies, many market participants—individuals and institutions alike—still seek improvements: lower fees, simpler workflows, transparent custody, and instant or near-instant settlement. With the rise of blockchain technology, we have seen attempts to modernize and streamline how assets trade, settle, and record ownership. Yet, legal, regulatory, and technical hurdles have slowed large-scale adoption.

Enter Permuto Capital and its novel structure for Microsoft stock—split into two distinct certificates that separate dividend rights from the share’s price appreciation. Under the hood, Gene Hoffman (CEO of Chia Network, Inc., often referred to as CNI) and his team have laid out how this approach—relying on the Chia blockchain—may provide not only a simpler path to equity ownership but also a brand-new asset class with potential global reach.

This article distills the essence of a recent interview with Gene Hoffman, covering the structure, advantages, and future roadmap of Permuto Capital’s new equity vehicle for trading Microsoft stock, and examining why the Chia blockchain is a perfect fit for the next generation of finance.

2. What Is Permuto Capital?

Permuto Capital is a joint venture with roots in both the traditional finance (TradFi) world and the blockchain sphere. It brings together individuals from:

- 3V Capital Partners (formerly involved with Credit Suisse underwriting).

- Chia Network, Inc. (CNI), headed by Gene Hoffman, who has extensive public-company experience and a deep understanding of regulatory frameworks.

Goal:

- To offer a new type of tradable vehicle for equities, beginning with Microsoft shares.

- To split a single share of stock into two separate certificates: one carrying all dividend rights, the other representing the appreciation (i.e., price movement) rights.

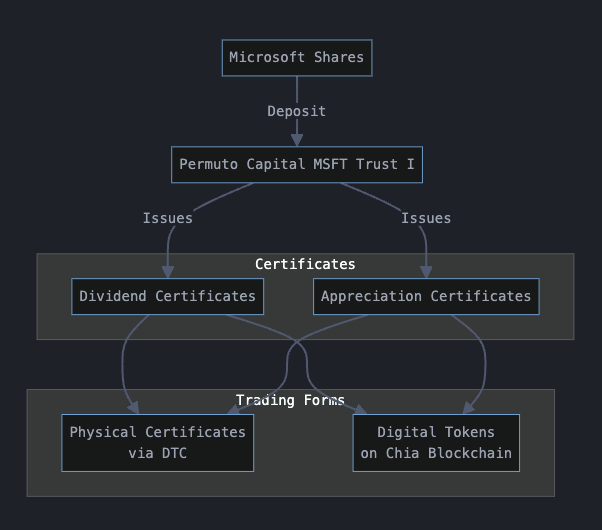

Essentially, Permuto has devised a trust that holds Microsoft shares and then issues two new “derivative” certificates tied to those shares. These instruments trade on a national exchange (like NASDAQ) and simultaneously on the Chia blockchain. The trust itself, overseen by U.S. Bank, ensures that the original Microsoft shares remain custody-protected and accounted for under well-known regulatory parameters.

You can find more about Permuto here:

- X: @permutocapital

- Website: https://permuto.capital

3. Splitting the Stock: Dividends vs. Appreciation

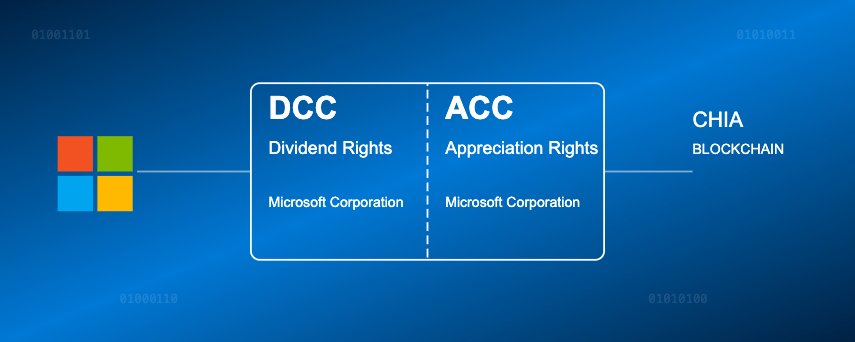

One of the most interesting features of Permuto Capital’s approach is splitting a share of Microsoft into:

- Dividend Certificate (DC) – Grants the owner the dividend payouts from Microsoft for as long as the company continues to pay them.

- Appreciation Certificate (AC) – Grants the owner the remaining economic rights of the share (price appreciation/depreciation and voting, minus the dividend).

Why Separate Dividends from Appreciation?

- Attracting New Investors: Institutions like insurance companies or pension funds are often more interested in predictable cash flow (dividends) than long-term capital appreciation. These entities may overlook certain high-growth tech stocks because their main focus is yield or because complicated dividends create extra tax or bookkeeping overhead.

- Tax Efficiency: Some individual or institutional investors prefer to avoid receiving dividends. Dividends trigger immediate tax events annually, which can reduce the net yield for certain investors. By stripping out the dividend, the appreciation certificate becomes “naturally leveraged,” offering the potential for slightly exaggerated price swings (both up and down) while avoiding the annual tax event that dividends typically create.

- Customized Exposure: Young investors might want all appreciation and no dividend tax overhead. Retirees or certain conservative funds might be all about consistent yield. Now, each group can buy exactly the piece that fits their strategy.

In short, it’s about letting investors decide which piece—dividend or appreciation—they want to hold, thus broadening the pool of potential buyers.

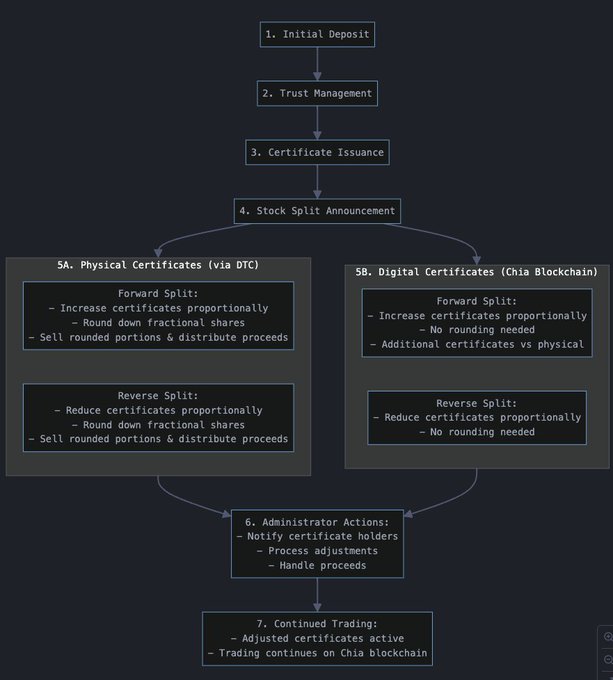

Microsoft Stock Split Process Flow:

4. Why Microsoft? The First Trust Explained

When launching something as innovative as splitting a share into separate certificates, choosing Microsoft as the first example was strategic:

- Global Brand Recognition: Microsoft is one of the largest companies in the world with consistent dividends.

- Mature Dividend History: Microsoft’s stable and growing dividend payments make for easy modeling of returns.

- Market Acceptance: Microsoft is considered relatively stable and “blue chip,” so institutional investors view it as only slightly more risky than government bonds.

Result: Investors are more comfortable dipping their toes into an unorthodox structure if the underlying asset is a well-understood, globally respected company.

5. Inside the Trust: Fees, Mechanics, and the Role of US Bank

A critical piece of the Permuto puzzle is the trust that holds the real Microsoft shares. US Bank (one of the largest banks in the U.S.) serves as the custodian. The custodian does not need to interact with the blockchain directly; their job is purely to hold the stock and ensure its safety under conventional regulatory rules.

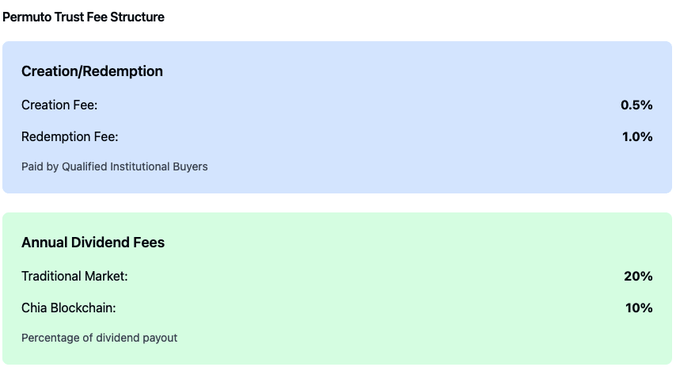

Fee Structure

Permuto Capital aims to earn revenue through:

- Creation/Redemption Fees: ~0.5% when new trust certificates are created (“creation”) ~1% when trust certificates are redeemed (“destruction”) These fees are primarily paid by Qualified Institutional Buyers (QIBs)—large brokerages, hedge funds, or insurance companies depositing or withdrawing big blocks of Microsoft shares into or out of the trust.

- Annual Dividend Fees:

Traditional Market: 20% of the dividend payout

On the Chia Blockchain: 10% of the dividend payout

This difference encourages certificate holders to “port” their positions onto the Chia blockchain for a lower annual fee. Yet, as Gene Hoffman notes, these fees also get reflected in the pricing of the certificates themselves—savvy investors factor them into valuations, effectively “discounting” the yield.

Simplicity for the End User

Individual investors holding a dividend certificate (DC) or appreciation certificate (AC) in a normal brokerage account have no direct custody burden. They can buy and sell these instruments just like any other stock. Meanwhile, if they wish to jump into the Chia ecosystem and manage them with private keys, they can move their holdings on-chain.

6. Regulatory Path: The S-1 Filing and SEC Outlook

Permuto Capital has officially filed what’s known as an S-1 with the U.S. Securities and Exchange Commission (SEC). This filing is a standard process for new public securities offerings, such as an IPO or, in this case, a novel equity certificate.

Timeline Considerations

- Typical Turnaround: The SEC often takes 3–4 months for a first pass. Additional questions, clarifications, or market conditions could extend this.

- Confidence in a 2025 Launch: The team believes that because the trust’s structure is relatively straightforward—just Microsoft shares with a well-understood dividend—complications may be minimal.

- First-Mover Regulatory Friction: By forging a new path, the first trust often carries heavier legal diligence and accounting complexities. Once Permuto has an official “green light,” subsequent trusts (e.g., other large dividend-paying tech or industrial stocks) can follow more easily.

Given that the structure is both an SEC-registered product and partially integrated with the Chia blockchain, some observers worry that the SEC’s stance on digital assets will complicate matters. However, Hoffman emphasizes that regulators have encountered digital asset proposals before. While they’re likely to ask the normal battery of questions (especially regarding custody and market structure), there’s nothing inherently incompatible about a trust that also operates on a blockchain, so long as the standard disclosures and filings are in place.

7. How the Chia Blockchain Fits In

Why Chia?

Chia (XCH) is a “coinset model” blockchain that handles transactions very differently than the classic Ethereum or Bitcoin approaches. It was designed to be:

- Energy-efficient through Proof of Space and Time.

- Rich in on-chain capabilities like “offer files,” which allow true peer-to-peer trades.

- Legally and compliance-friendly via standard structures that let institutions handle private keys or multi-signature vaults in an auditable manner.

Offer Files and Peer-to-Peer Trading

In the conventional stock world, we assume that the only place to trade shares is the stock exchange or a regulated ATS (Alternative Trading System). On Chia, an offer file can effectively replicate the scenario of handing someone a physical stock certificate in exchange for a briefcase full of cash—only digitally, cryptographically secure, and not limited to bank hours.

How it works:

- You post an offer file that states: “I have X shares (or certificates) to sell for Y USDC.”

- If a buyer accepts, the trade executes directly on the Chia blockchain with no centralized intermediary.

- This peer-to-peer structure does not turn the underlying smart contract (in the typical sense) into an unregistered exchange. Instead, it’s a series of user-signed settlement instructions.

- It’s akin to meeting in a park with a handshake on an old-fashioned paper certificate—just more secure, more transparent, and less susceptible to human error or nefarious behaviors.

Result:

- 24/7/365 potential liquidity across global time zones.

- No forced reliance on “market hours”—you can trade your DC or AC whenever you wish, if there’s a matching buyer or market maker standing by.

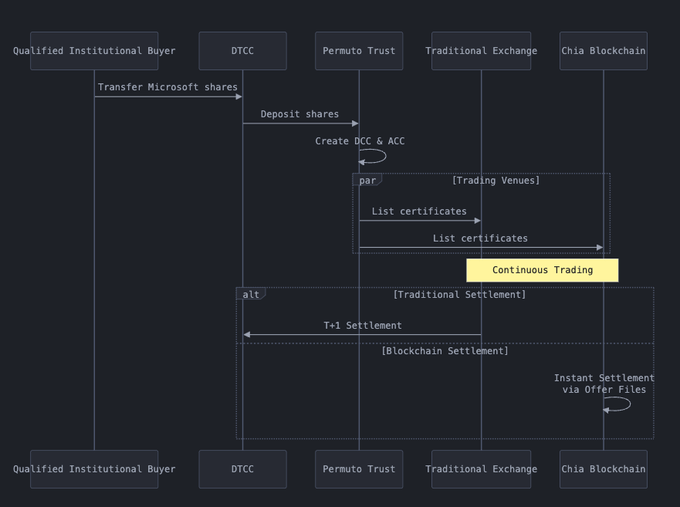

8. From DTCC to Blockchain: Bridging Traditional Markets

Currently, all mainstream U.S. equities must settle through the Depository Trust & Clearing Corporation (DTCC). If you own a share of a public company in your brokerage account, DTCC’s subsidiary Cede & Co. is the official “registered owner,” and your brokerage firm tracks that you are the beneficial owner.

Where DTCC fits with Permuto

- When a QIB (e.g., Morgan Stanley) wants to deposit real Microsoft shares into the Permuto trust, they instruct DTCC to transfer shares from their brokerage account to the trust’s custodian account (held at US Bank).

- After receiving the deposit, Permuto issues the newly created DCs and ACs. Those can then be distributed to the QIB’s accounts—either in the traditional DTCC world or on the Chia blockchain.

Administrative Evolution

While DTCC is not going away anytime soon, the on-chain approach provides:

- Faster settlement

- Eliminated multi-party reconciliations

- Granular auditability

- Potential for direct investor empowerment (voting, corporate actions, tax reporting)

In the interview, Gene Hoffman pointed out how DTCC, in the long run, may evolve to adapt to these new structures rather than vanish. It is similar to how the music industry transitioned from CDs to streaming—legacy players often find new roles once they adapt to modern distribution channels.

9. Market Makers, Offers, and the Magic of Peer-to-Peer

Market makers are essential to ensuring liquidity in any trading venue—be it the NYSE, NASDAQ, or a decentralized marketplace on the blockchain. They continuously post bids and asks, profiting on the spread.

Bridging On-Chain and Off-Chain

An interesting aspect for Permuto is that the same or closely related market makers could potentially operate on:

- A national securities exchange where the trust certificates trade in the conventional manner.

- The Chia blockchain side, posting or fulfilling offers for DCs and ACs in stablecoins or other forms of payment.

To do this, they will:

- Integrate Chia-based custody solutions, likely using multi-signature vaults.

- Automate the acceptance and generation of offer files.

- Tie these processes into their standard pricing algorithms that monitor off-chain prices to keep on-chain quotes consistent.

Automated Market Making vs. Traditional Tools

On blockchains like Ethereum, many are familiar with “AMMs” (Automated Market Makers) in the sense of liquidity pools and constant function bonding curves. Chia’s approach is slightly different: it encourages discrete offer-file-based trades that can be aggregated or partially filled in real-time, much like a traditional limit order book, but executed peer-to-peer.

Market makers in the interview indicated that the technology adaptation is straightforward once the business logic is clear. They already run sophisticated automated market-making software on the big exchanges, so bridging to Chia is a matter of integrating new APIs and ensuring legal compliance with the trust’s mechanics.

10. Global Implications: Beyond the US Market

Another often-touted advantage of a blockchain-based approach is global reach. In theory, anyone with a compatible wallet and stablecoin can trade in the trust certificates.

However, Gene Hoffman underscores that while global adoption is an attractive side benefit, it’s not necessarily the first wave of targeted users. Why?

- Institutional Demand: The largest blocks of DC and AC are likely to be deposited or withdrawn by major funds, pension systems, or insurance companies.

- Regulatory Complexity: Various countries treat foreign stock ownership differently for taxation and compliance. That said, certain subsets of international investors might now see a big advantage in holding only the AC portion (for simpler tax treatment), or only the DC portion for pure yield.

In short, the world of global adoption is more of a long-term horizon, especially interesting for smaller private funds or individual investors who want exposure to US equities without some of the usual friction.

11. Voting Power and Corporate Governance

When a company has a corporate action—like a vote on a merger, electing board members, or spinning off a division—stockholders are entitled to vote. But in the Permuto structure, the trust is the direct owner of the underlying shares. How do these votes flow downstream?

- Permuto receives the proxy question from Microsoft (or any underlying company).

- Permuto then gathers votes from holders of DCs and ACs in proportion to each certificate’s share of the total equity value.

- Permuto aggregates these votes and then instructs the custodian to place the trust’s block of shares accordingly.

Amplified Voting

Hoffman notes a crucial difference from typical ETFs:

- If an ETF holds 5% of a company, the fund’s managers will cast that 5% block. They decide which way to vote, often ignoring individual requests from ETF shareholders.

- In this trust, each certificate holder actually directly participates in the vote. The trust amplifies the aggregated votes and casts them in direct proportion to how DC and AC holders collectively decide.

While this is a novel improvement in shareholder democracy, it also introduces complexities if the trust ever were to accumulate a very large portion of outstanding shares. Permuto acknowledges that if they owned too big a chunk—somewhere above 33%—weird governance battles might arise in extreme proxy fights. Thus, they plan to remain well below that threshold, or else re-engineer the trust to limit how voting rights are handled.

12. Long-Term Vision: Future Trusts and Expansion

Once Microsoft is live, the path is open for Permuto to replicate this structure across multiple dividend-paying stocks—especially large-cap or mid-cap companies with stable dividend histories. Think of major telecoms, oil and gas, or consumer staples firms that combine:

- Growth potential

- Steady or rising dividends

- Enough name recognition to interest a broad set of investors

Additionally, direct partnerships with the underlying company itself could simplify the trust relationship. For instance, if a public firm wants to actively separate its dividend from its appreciation, it could contract directly with Permuto to create a custom trust—no external custodian needed.

13. Why This Matters: Key Takeaways

- Simplified Choice for Investors: Splitting shares into two separate certificates—dividend vs. appreciation—lets each investor fine-tune their exposure.

- Potentially Lower Fees: While new issues, redemptions, and dividend fees exist, the free market should price them in. For on-chain holders, the annual fee is smaller, encouraging deeper adoption of the Chia ecosystem.

- Better Global Accessibility: In principle, anyone with an internet connection and some stablecoins can hold or trade these trust certificates—though local regulations vary.

- Streamlined Governance: Unlike an ETF manager deciding votes, Permuto pass-through voting gives real owners more direct input in corporate decisions.

- On-Chain Audit Trail: The Chia blockchain provides an immutable record of all trades, ownership changes, and distributions. That can simplify tax reporting, compliance, and reduce overhead for investors and institutions.

- 24/7/365 Trading: Using the Chia blockchain’s peer-to-peer offer file mechanism, trades can happen at any time. Liquidity will, of course, depend on how many participants and market makers connect to the marketplace.

14. Conclusion: The Road Ahead

In many ways, Permuto Capital is blazing a trail into the future of finance. By combining time-tested financial instruments—a simple trust holding a single large-cap stock—with cutting-edge blockchain technology, they aim to build a best-of-both-worlds solution. Here are some closing insights to bring everything together:

- Regulatory Pioneer: The S-1 filing with the SEC is a crucial barrier to entry. If Permuto secures approval, it opens the floodgates for other similar vehicles.

- Microsoft as a ‘Flagship’: Proving the concept with one of the world’s biggest technology corporations sets a strong precedent.

- Technology Collaboration: Chia Network’s development of Cloud Wallet and deeper enterprise solutions underscores how crucial integrated, user-friendly tools will be for bridging large institutions to on-chain assets.

- Global Impact: From large pension funds to small family offices, the notion of customizing your equity exposure—pure yield or pure growth—could reshape how markets think about “one-size-fits-all” stock shares.

- Ecosystem Growth: Should Permuto’s trust structure gain popularity, the Chia ecosystem stands to benefit from increased adoption. Tools like offer files, multi-signature vaults, and robust compliance services will become the standard among next-generation financial instruments.

Ultimately, the real excitement lies in seeing an actionable system—where you can log into a platform, buy or sell either the dividend certificate or the appreciation certificate on the Chia blockchain, and truly hold it peer-to-peer, outside of the conventional 9:30 a.m. to 4:00 p.m. trading window. The convenience, potential cost savings, and expanded investor base could bring momentum to this novel financial product.

If Permuto Capital’s journey proves successful, this “dual listing”—one foot in mainstream finance and the other in blockchain—may become a new normal. Investors seeking pure yields, big growth, or a balanced blend can tailor their portfolios with surgical precision, all while retaining transparent voting rights and easy transacting.

In short, we stand on the cusp of a transformative shift—one that reimagines what it means to own a share of stock in the modern era. Permuto Capital and Chia’s collaboration is an early but significant case study in bridging the gap between the old and new financial worlds. With eyes on the upcoming SEC review and the first wave of on-chain trading, the coming months will reveal just how quickly this new model could accelerate the transformation of legacy capital markets.